Autorisation

Pour vous connecter à l'espace personnel, effectuez les actions suivantes.

1. Ouvrez la page de l'espace personnel.

TEST: https://dev.bpcbt.com/mp3

PROD:

Si la connexion n'a pas été effectuée, le formulaire de saisie de l'identifiant et du mot de passe s'affichera (voir image ci-dessous).

2. Dans les champs Identifiant et Mot de passe saisissez respectivement votre identifiant et mot de passe d'opérateur.

3. Cliquez sur le bouton Se connecter.

Si les données sont saisies correctement, la connexion à l'espace personnel sera effectuée.

Déconnexion du système

Pour vous déconnecter de l'espace personnel, cliquez sur le bouton  , situé dans la partie supérieure droite de l'interface de l'espace personnel.

, situé dans la partie supérieure droite de l'interface de l'espace personnel.

Changement de langue de l'interface

Pour changer la langue dans laquelle s'affiche l'interface de l'espace personnel, effectuez les actions suivantes.

- Effectuez la connexion à l'espace personnel.

- Dans la partie supérieure du panneau de contrôle de l'espace personnel cliquez sur l'icône avec l'image du globe.

La liste des langues d'interface disponibles s'affichera (voir image ci-dessous).

- Cliquez sur l'icône de la langue souhaitée. La page de l'espace personnel s'affichera automatiquement dans la langue sélectionnée.

Travail avec l'API

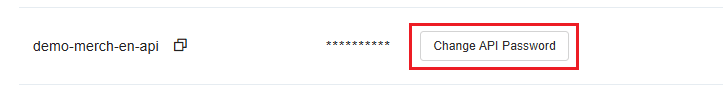

Grâce à l'API, vous pouvez créer des intégrations de paiement uniques. Par exemple, connecter le paiement depuis une page de paiement spécialement créée. Des informations supplémentaires sur l'API sont disponibles ici. Lors de la création du Marchand, vous recevez un e-mail avec l'identifiant et le mot de passe à usage unique. Après cela, vous pouvez générer vous-même le mot de passe API sur la page Travail avec l'API sur le portail vendeur.

Pour afficher la page Travail avec l'API, cliquez sur ![]() dans le panneau latéral gauche.

dans le panneau latéral gauche.

La page suivante s'affichera.

Les actions suivantes sont disponibles :

Création du mot de passe API. Pour cela, cliquez sur Créer mot de passe API.

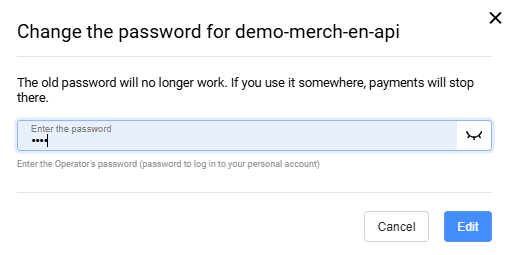

Modification du mot de passe API. Pour cela, cliquez sur Modifier mot de passe API et confirmez l'action dans la fenêtre qui s'ouvre :

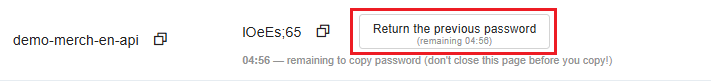

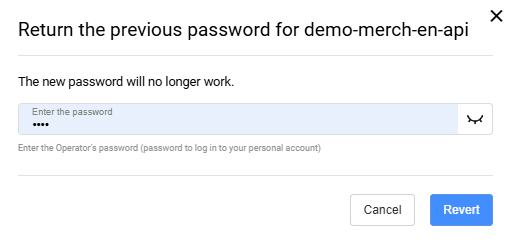

Après avoir changé le mot de passe, vous pouvez restaurer le mot de passe précédent dans les 5 minutes. Cliquez sur Restaurer mot de passe précédent et confirmez l'action dans la fenêtre qui s'ouvre :

Paramètres

Pour accéder à la section Paramètres, dans le menu de navigation de gauche de l'espace personnel, sélectionnez l'élément Paramètres (icône ![]() ).

).

La section Paramètres permet de

- établir les paramètres principaux

- activer les notifications de rappel

- modifier le mot de passe d'accès à l'espace personnel

- indiquer l'adresse e-mail pour la possibilité de récupération du mot de passe de l'espace personnel

- définir les paramètres de fonctionnement de l'espace personnel (non disponible dans la version de démonstration)

Paramètres principaux

La section Paramètres principaux permet à l'employé du magasin de configurer certains paramètres de compte et autorisations.

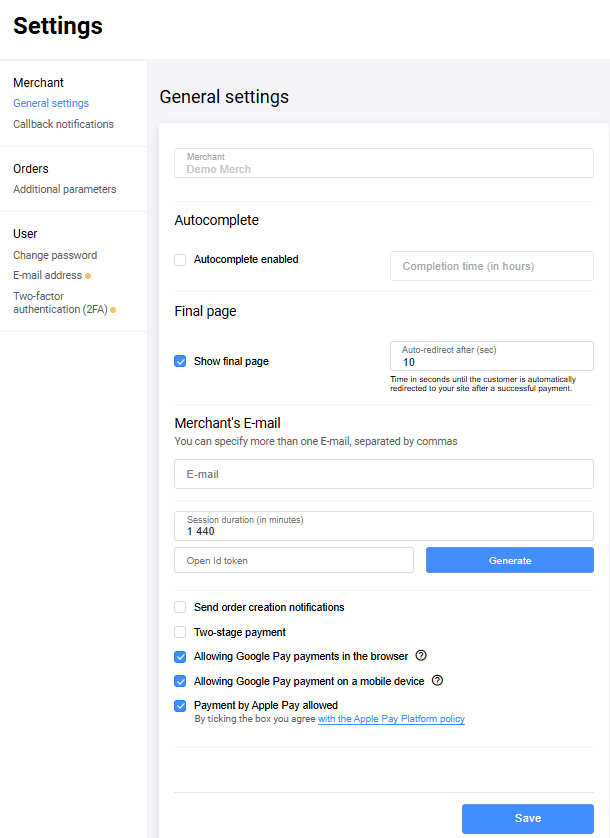

Pour aller à la section Paramètres principaux, sélectionnez Paramètres dans le menu latéral, puis sélectionnez Paramètres principaux dans le bloc Vendeur. La page des paramètres de compte s'affichera, comme montré ci-dessous.

La description des paramètres est donnée dans le tableau ci-dessous :

| Champ | Description |

|---|---|

| Afficher la page finale | Si activé, permet d'afficher la page finale après l'achèvement du paiement. |

| Autocomplétion activée | Si activé, permet d'indiquer dans le champ Temps d'achèvement le nombre d'heures après lequel les paiements à deux étapes seront automatiquement achevés. |

| Adresse e-mail du vendeur, sur laquelle seront envoyées les notifications. Dans ce champ, on peut saisir plusieurs adresses e-mail (séparées par des virgules). Les déclencheurs pour l'envoi de notifications sont configurables. Peuvent être configurés sur des événements tels que le changement de statut de transaction, la création de données de paiement enregistrées, etc. | |

| Durée de session (en minutes) | Délai accordé pour la saisie des données de carte depuis le moment de l'enregistrement du paiement. Si le paiement n'est pas effectué dans le délai indiqué, la commande passera au statut REFUSÉ. Après cela, un callback sera envoyé, s'il est configuré. Le changement de statut de telles commandes s'effectue selon un planning, donc de petits retards sont possibles. Si vous demandez le statut d'une telle commande, et que le temps a expiré pour celle-ci, la commande sera immédiatement transférée au statut REFUSÉ. |

| Envoyer des notifications de création de commande | Si activé, le vendeur recevra une notification par e-mail de la création de commande |

| Paiement à deux étapes | Autorisation d'utiliser le schéma de paiement à deux étapes |

| Envoi de notifications au client par SMS | Si activé, le client recevra des notifications SMS |

| Paiement Google Pay autorisé dans le navigateur | Autorisation des paiements Google Pay dans le navigateur |

| Paiement Google Pay autorisé sur appareil mobile | Autorisation des paiements Google Pay sur appareil mobile |

| Paiement par Apple Pay autorisé | Autorisation d'utiliser Apple Pay |

| Clé publique | Vous pouvez générer une clé publique (token Open ID). La saisie manuelle de la clé est également disponible. Voir plus de détails ici |

Cliquez sur le bouton Enregistrer.

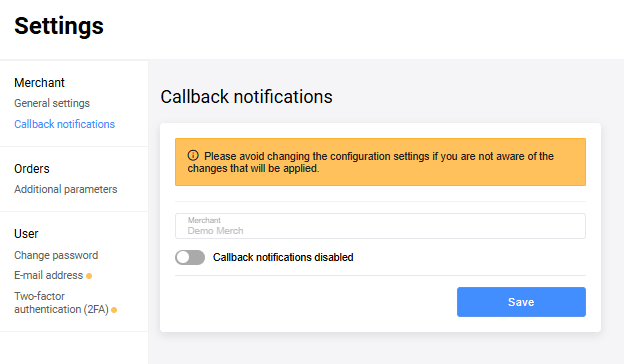

Notifications callback

Le portail vendeur permet de configurer les notifications de rappel. Cette section peut être masquée pour certains Vendeurs. Par conséquent, si vous ne la voyez pas ou si vous avez des questions, contactez le service d'assistance, et nous serons ravis de vous aider.

Des informations supplémentaires sur les notifications de rappel sont disponibles ici. L'onglet Notifications callback est disponible ici : Paramètres → Vendeur → Notifications callback.

Si l'utilisateur a des vendeurs affiliés, la sélection du vendeur devient disponible dans le menu déroulant Vendeur.

Pour activer les paramètres de notifications de rappel, cliquez sur le commutateur Notifications callback désactivées :

Les paramètres de notifications de rappel sont décrits ci-dessous.

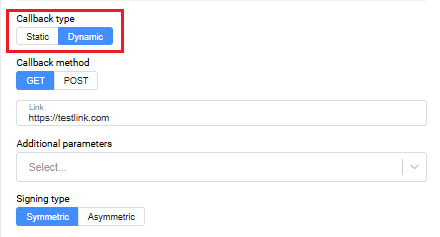

Type de callback

Si le vendeur a déjà configuré le type de notification Dynamique, les deux options dans la zone Type de signature ne seront pas disponibles pour sélection.

Méthode HTTP

Choisissez l'une des deux méthodes proposées : GET ou POST.

Lien

Saisissez l'URL vers laquelle les notifications seront envoyées, par exemple : https://test.com. Il est permis d'indiquer plusieurs liens (séparés par des virgules et sans espaces).

Paramètres supplémentaires

Saisissez l'ordre des paramètres qui seront transmis dans le callback, séparés par des virgules.

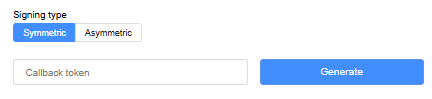

Type de signature

Choisissez l'un des types de signature : Symétrique ou Asymétrique. Si le type de signature symétrique est sélectionné, il est possible de générer un token callback. De plus, si le type de signature Symétrique est sélectionné, il est possible de saisir le token manuellement.

Si le type de signature asymétrique est sélectionné, le bouton Générer sera inactif. La clé pour la signature asymétrique peut être obtenue auprès du service d'assistance.

Opérations

Sélectionnez les événements pour lesquels une notification de rappel sera envoyée. La notification sera envoyée aussi bien lors de l'exécution réussie de l'opération qu'en cas d'erreur.

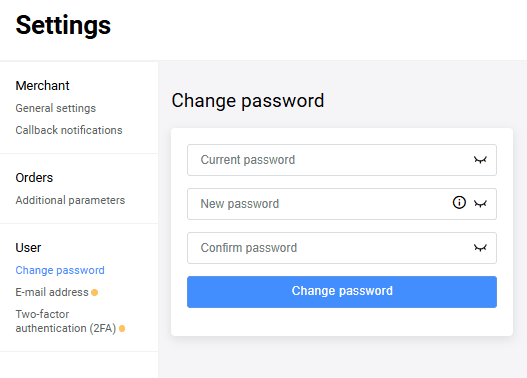

Changement de mot de passe

Pour modifier le mot de passe d'accès à l'espace personnel, suivez les étapes suivantes.

- Connectez-vous à l'espace personnel.

- Dans le panneau de gestion à gauche, allez dans la section Paramètres, en cliquant sur l'icône

.

. - Sur la page qui s'affiche, sélectionnez l'onglet Changement de mot de passe. La page prendra l'aspect suivant.

- Dans le champ Mot de passe actuel, saisissez votre mot de passe actuel.

-

Dans les champs Nouveau mot de passe et Nouveau mot de passe encore une fois, saisissez le nouveau mot de passe.

Le mot de passe doit répondre aux exigences suivantes :

- Le mot de passe ne doit pas contenir le nom du magasin ou l'identifiant d'un des utilisateurs liés au marchand auquel appartient l'utilisateur qui modifie le mot de passe (y compris le changement de casse).

- Le mot de passe saisi par l'utilisateur doit obligatoirement contenir des symboles des groupes énumérés ci-dessous :

- lettres majuscules de l'alphabet latin (A-Z)

- lettres minuscules de l'alphabet latin (a-z)

- chiffres (0-9)

- caractères spéciaux (! "#;:? * () + = < > , . { } )

- La longueur du mot de passe doit être d'au moins 8 caractères.

Cliquez sur le bouton Changer le mot de passe.

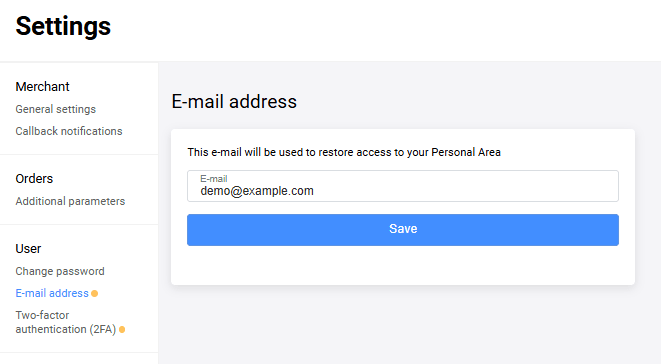

Adresse électronique

Définissez l'adresse électronique qui sera utilisée pour la récupération de l'accès à l'espace personnel.

- Connectez-vous à l'espace personnel.

- Dans le panneau de gestion à gauche, allez dans la section Paramètres, en cliquant sur l'icône

.

. - Dans la section Adresse électronique, saisissez l'adresse qui sera utilisée pour la récupération de l'accès.

- Cliquez sur Enregistrer.

Un e-mail de confirmation sera envoyé à l'adresse électronique indiquée. Une fois que l'adresse électronique sera confirmée, la modification de l'adresse sur cette page ne sera plus disponible. Si vous devez changer l'adresse électronique encore une fois, contactez l'équipe de support.

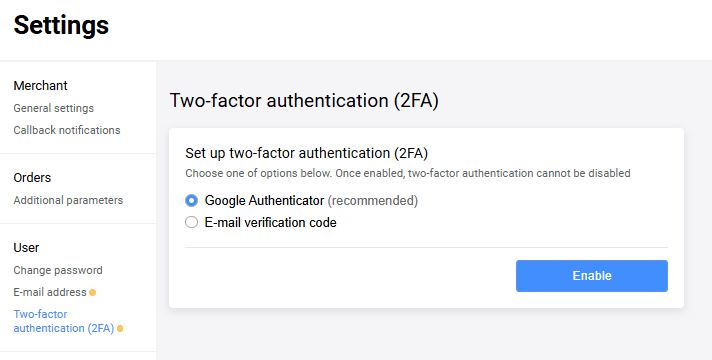

Authentification à deux facteurs

Vous pouvez configurer l'authentification à deux facteurs pour assurer un niveau de sécurité supplémentaire, garantissant que vous seul pourrez avoir accès à votre Espace personnel. Dans ce cas, lors de la connexion à l'Espace personnel, il est nécessaire de saisir non seulement l'identifiant et le mot de passe, mais aussi le code d'authentification généré par l'application Google Authenticator, ou envoyé sur votre adresse électronique (selon la méthode d'authentification activée).

Pour configurer l'authentification à deux facteurs, dans le panneau de gestion à gauche, allez dans la section Paramètres > Authentification à deux facteurs. Deux méthodes d'authentification sont proposées au choix :

Google Authenticator (recommandé)

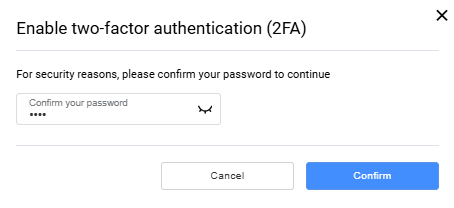

- Dans la liste proposée, sélectionnez Google Authenticator (recommandé) et cliquez sur le bouton Activer.

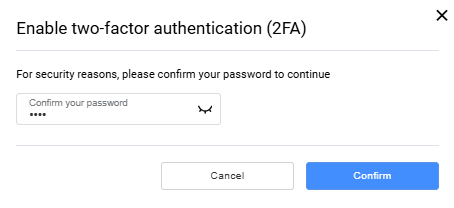

- Un formulaire apparaît où vous devez confirmer votre mot de passe de connexion à l'Espace personnel :

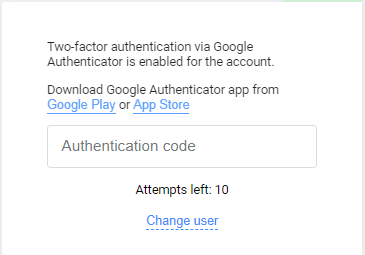

- Téléchargez/ouvrez l'application Google Authenticator sur votre appareil. Saisissez la clé secrète ou scannez le code QR pour ajouter votre compte dans l'application Google Authenticator. L'application générera un code. Saisissez le code généré dans le champ Saisissez le code à 6 chiffres.

- Après avoir configuré l'authentification à deux facteurs via Google Authenticator, lors des prochaines connexions à votre Espace personnel, le code Google Authenticator sera demandé :

Code de confirmation par e-mail

- Dans la liste proposée, sélectionnez Code de confirmation par e-mail et cliquez sur le bouton Activer.

- Si votre adresse électronique n'est pas indiquée dans les paramètres et n'est pas confirmée, veuillez d'abord le faire. Si tout est configuré, suivez les étapes suivantes ci-dessous.

- Un formulaire apparaît où vous devez confirmer votre mot de passe de connexion à l'Espace personnel :

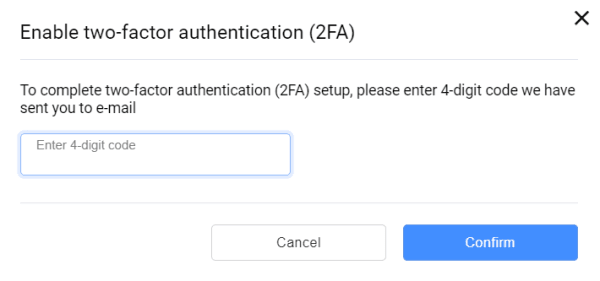

- Pour terminer la configuration de l'authentification à deux facteurs, veuillez saisir le code à 4 chiffres qui vous a été envoyé à votre adresse e-mail :

- Après avoir configuré l'authentification à deux facteurs via E-mail, lors des prochaines connexions à votre Espace personnel, un code sera demandé, qui sera envoyé à votre adresse e-mail.

Analytique

Pour afficher la page Analytique, cliquez sur l'icône ![]() dans le panneau latéral gauche.

dans le panneau latéral gauche.

Sur la page s'afficheront les informations sur les transactions :

Le menu supérieur permet de sélectionner la période pour laquelle les informations sur les transactions seront affichées. Les valeurs suivantes sont disponibles :

- Jour ;

- Semaine ;

- Mois ;

- Année.

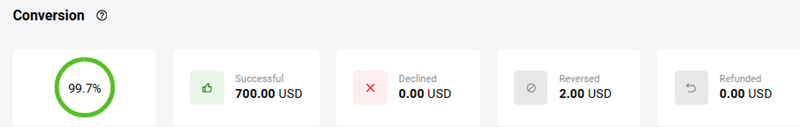

Le graphique Conversion affiche le rapport en pourcentage des transactions réussies par rapport au nombre total de transactions.

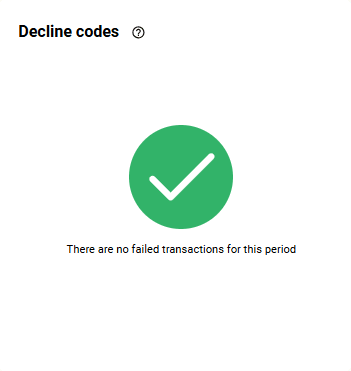

Le graphique Codes de refus (voir l'image ci-dessous) affiche les principales causes d'erreurs lors du traitement des commandes.

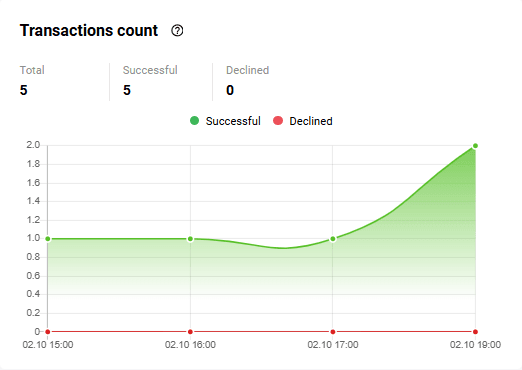

Le graphique Nombre de transactions affiche les informations sur les transactions pour la période sélectionnée.

Dans ce cas, les champs suivants s'affichent sur le graphique :

- Total des transactions - nombre total de transactions ;

- Réussies - nombre de transactions réussies ;

- Non réussies - nombre de transactions lors du traitement desquelles une erreur s'est produite.

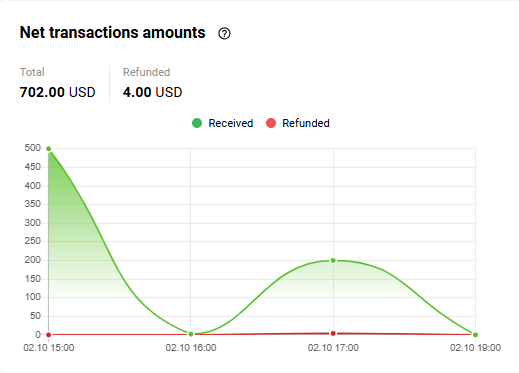

Sur le graphique Chiffres d'affaires s'affichent les informations sur les montants des transactions réussies et rejetées.

Sur le graphique Chiffre d'affaires confirmé s'affichent les informations sur les montants confirmés des transactions réussies et retournées/rejetées.

Facturation de paiement

Vous pouvez envoyer une facture à l'acheteur pour le paiement de marchandises ou services par courrier électronique. Pour cela, utilisez la section Facture de paiement de l'espace personnel. Après l'envoi de la facture, l'acheteur reçoit un courrier et suit le lien qu'il contient vers la page de paiement.

Envoi du lien vers le formulaire de paiement par email

Pour envoyer une facture au client et lui envoyer un lien vers la page de paiement par courrier électronique, effectuez les actions suivantes.

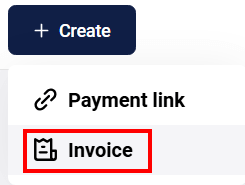

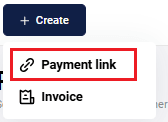

- Accédez à la section Facture de paiement de l'espace personnel, en sélectionnant Facture de paiement dans le menu de gauche. Vous pouvez également ouvrir cette section en cliquant sur le bouton Créer en haut de l'espace personnel et sélectionner Facture.

-

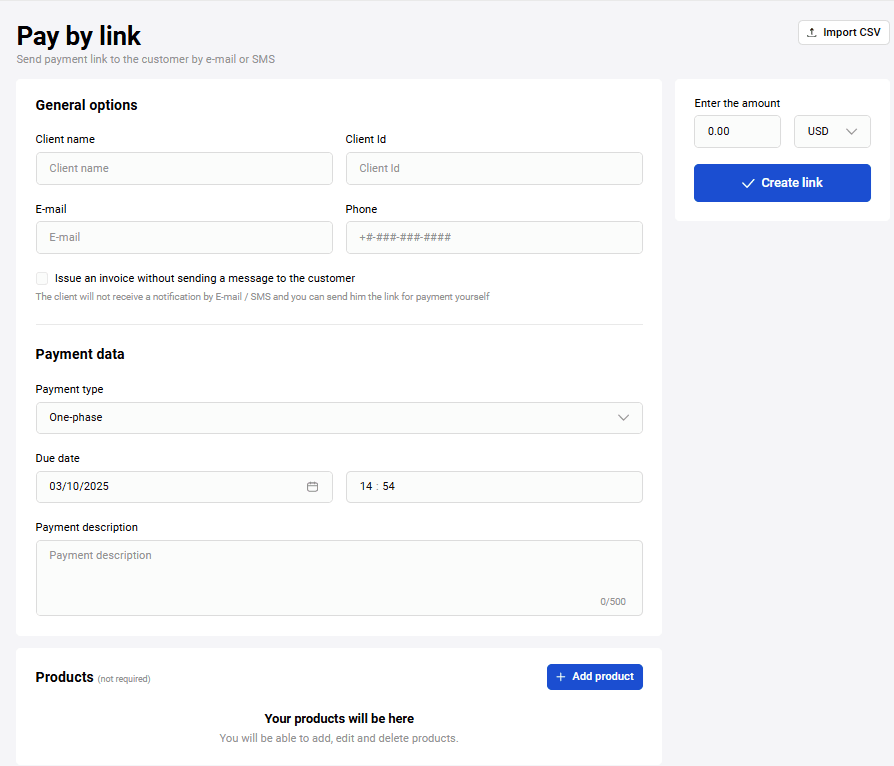

La page de saisie des paramètres d'envoi s'affichera :

-

Configurez les paramètres en vous guidant du tableau ci-dessous.

Paramètre Description Nom complet du client Nom de famille, prénom et patronyme du client. Les données saisies dans ce champ s'affichent dans le courrier contenant le lien vers la page de paiement Id client Identifiant du client dans le système de la boutique Téléphone Numéro de téléphone. Il faut toujours indiquer le code du pays, en pouvant indiquer ou ne pas indiquer le signe +. Ainsi, les variantes suivantes sont admises :-

+449998887766; -

449998887766. Nombre de chiffres autorisé : de 7 à 15.

E-mail Adresse de courrier électronique à laquelle sera envoyé le lien de paiement Type de paiement Choisissez l'une des deux variantes. - Une étape — après l'effectuation du paiement, aucune action supplémentaire de votre part n'est requise.

- Deux étapes — après que le client a confirmé le paiement, vous devez finaliser le paiement dans l'espace personnel. Jusqu'à ce que vous fassiez cela, l'argent sera retenu sur le compte du client (mis en attente) jusqu'au moment de la confirmation du paiement par vous ou jusqu'à l'expiration du délai d'attente de confirmation.

En cas de confirmation du paiement par vous, l'argent est transféré sur votre compte.

En cas d'expiration du délai d'attente de confirmation, le blocage des fonds sur le compte du client est levé.

Devise Choisissez la devise du paiement dans la liste déroulante Langue Choisissez la langue de la facture dans la liste déroulante. Les valeurs disponibles sont FR et EN Payer avant Indiquez la date et l'heure avant lesquelles il est possible de payer la facture. Après l'expiration de ce délai, il sera impossible de payer la facture émise Description du paiement Description du paiement sous forme libre Saisissez le montant Indiquez le montant du paiement. Si la commande contient un panier de marchandises pré-rempli, ce champ est rempli automatiquement -

-

Cliquez sur le bouton Créer le lien.

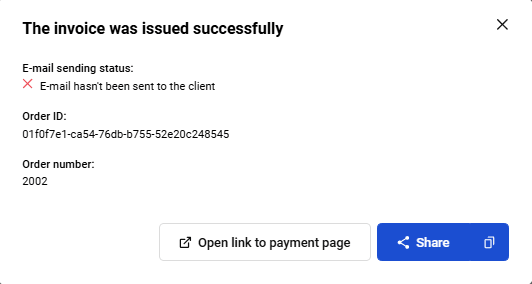

En cas d'envoi réussi, le lien vers le formulaire de paiement s'affichera ci-dessous :

Vous pouvez consulter la page de paiement envoyée au client en cliquant sur le bouton Ouvrir le lien de paiement.

Formation du panier de marchandises lors de l'émission d'une facture de paiement

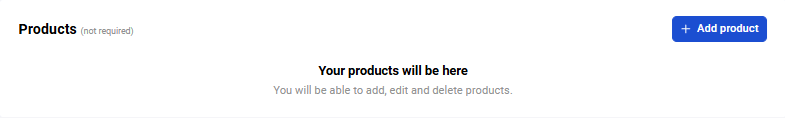

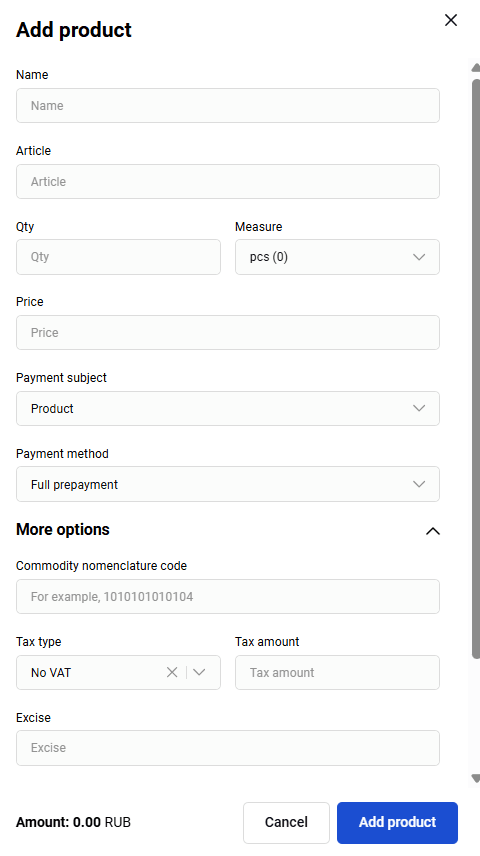

Lors de la formation d'une facture de paiement, vous pouvez indiquer un panier de marchandises pour la commande. La section Marchandises se trouve sous le formulaire de création du lien de paiement :

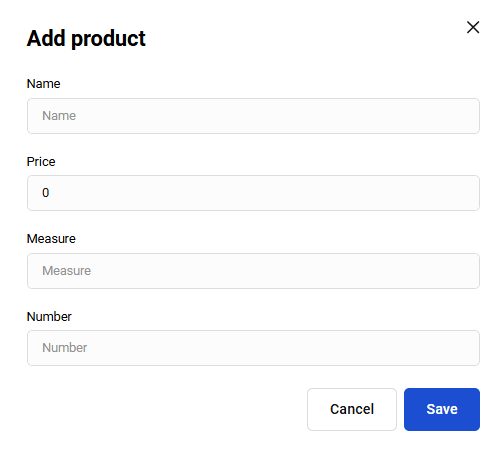

- Pour ajouter une marchandise au panier, cliquez sur le bouton Ajouter une marchandise et sélectionnez Nouveau produit. Le formulaire avec les paramètres de la marchandise à ajouter s'affichera.

-

Remplissez les champs nécessaires en vous guidant du tableau ci-dessous.

Champ Description Dénomination Dénomination du produit ou service. Champ obligatoire. Article Article de la position de marchandise. Champ obligatoire. Qté Quantité de marchandise pour cette position de marchandise. Champ obligatoire. Unité mes. Unités de mesure, par exemple : l — litres, pcs. — pièces. Champ obligatoire. Prix Prix par unité de position de marchandise. Champ obligatoire. Somme Somme totale pour toutes les unités d'une position de marchandise. Calculée automatiquement lors du remplissage des champs Prix et Qté. Cliquez sur Ajouter un produit.

Répétez les actions nécessaires pour chaque position du panier. Si nécessaire, pour supprimer une position ajoutée, cliquez sur le bouton

et confirmez l'action. Pour supprimer tous les produits, cliquez sur le bouton Supprimer tous les produits et confirmez l'action.

et confirmez l'action. Pour supprimer tous les produits, cliquez sur le bouton Supprimer tous les produits et confirmez l'action.

Vous pouvez ajouter des produits depuis le catalogue, pour cela cliquez sur Ajouter et sélectionnez Produit du catalogue, puis sélectionnez le produit dans la fenêtre qui s'ouvre.

Après avoir ajouté un produit, vous pouvez l'éditer. Pour cela, cliquez sur la ligne du produit et modifiez les valeurs dans le formulaire d'édition.

Après avoir rempli le panier, émettez une facture au client.

Import de fichier CSV

Vous pouvez enregistrer une commande avec un panier, et ce panier peut être rempli automatiquement depuis un fichier CSV. Pour charger le panier automatiquement, cliquez sur le bouton Ajouter un produit et sélectionnez Charger CSV. Dans la fenêtre qui s'ouvre, sélectionnez le fichier qu'il faut charger sur votre appareil.

Il est possible de charger 2 types de fichiers qui contiennent :

- seulement le panier (ORDER_BUNDLE)

- le panier (ORDER_BUNDLE) et les données de commande (ORDER_PARAMS).

Notez qu'aucun champ n'est obligatoire, et seuls certains d'entre eux peuvent être utilisés pour remplir le panier.

Champs possibles des données du panier :

-

ItemCode- code du produit dans le système du magasin. -

Price- prix par unité de position de produit. -

Amount- montant du paiement dans les unités minimales de devise (kopecks, centimes, etc.). Pas plus de 12 caractères. -

Measure- unités de mesure, par exemple : l — litres, pcs. — pièces -

Quantity- quantité totale de positions de produits d'un même PositionId et leur unité de mesure. La description de ses attributs est présentée ci-dessous. -

Name- nom ou description du produit ou service sous forme libre.

Champs possibles avec les données de commande :

-

OrderNumber- numéro de commande (ID) dans le système du marchand, doit être unique pour chaque marchand. -

TotalAmount- montant de la commande plus commission, si elle existe. -

Merchant- identifiant du vendeur dans le système de passerelle de paiement. -

Currency- code de devise de paiement ISO 4217. -

Language- Clé de langue selon ISO 639-1. Si la langue n'est pas spécifiée, la langue par défaut spécifiée dans les paramètres du magasin est utilisée. -

AuthType- type d'authentification, valeurs possibles :0-PURCHASE,1-PRE_AUTH. -

Email- adresse électronique du client. -

Phone- Numéro de téléphone de l'acheteur. Il faut toujours indiquer le code du pays, en même temps on peut indiquer ou ne pas indiquer le signe +. -

Full name- nom complet du client. -

INN- INN. -

Passport- données de passeport. -

Sender- adresse électronique de l'expéditeur. -

Description- description de la commande dans n'importe quel format. -

ClientId- numéro de client (ID) dans le système du marchand — jusqu'à 255 caractères. -

Payment period- définissez la date et l'heure avant que la commande ne soit payée. Par exemple, 5D– 5 jours, 22H – 22 heures, 10M – 10 minutes.

Exemple de fichier avec données de panier :

ItemCode,Price,Amount,Measure,Quantity,Name

1,10,20,pieces,2,applesExemple de fichier avec données de commande et panier :

Télécharger l'exemple de fichier

Important : Pour assurer un traitement approprié du fichier, les valeurs des champs dans le fichier ne doivent pas contenir de virgules. Les virgules ne peuvent être utilisées qu'en tant que séparateurs de champs et leurs valeurs.

Exemple de remplissage incorrect des champs dans le fichier :

ItemCode,Name,Amount,Quantity,Measure,Price

123,apples,golden,20000,1,kg,20000Exemple de remplissage correct des champs dans le fichier :

ItemCode,Name,Amount,Quantity,Measure,Price

123,apples golden,20000,1,kg,20000Effectuer un paiement de test

Vous pouvez tester de manière autonome le processus de paiement au nom du client. Pour cela :

-

Générez une facture pour le client.

Accédez à la page de paiement en cliquant sur le bouton Lien de paiement dans le message de facturation réussie.

Choisissez le mode de paiement. Lors du paiement par carte, saisissez les données d'une des cartes de test.

Cochez Enregistrer ma carte si vous souhaitez créer des données de paiement enregistrées : dans ce cas, la saisie des données de carte ne sera pas nécessaire la prochaine fois.

Cliquez sur le bouton Payer. Pour confirmer l'opération, utilisez le code 3-D Secure indiqué pour la carte de test.

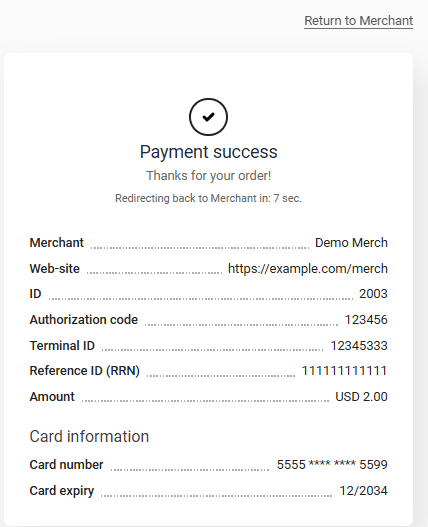

Page finale

Il est possible de configurer la réception des paiements de sorte qu'après un paiement réussi, le client soit redirigé vers la Page finale. Cette page contient les données sur le paiement et un lien de retour vers la boutique.

Le tableau ci-dessous décrit les données affichées sur la page finale.

| Champ | Description |

|---|---|

| Numéro de commande | Numéro de commande généré automatiquement dans le système du vendeur. |

| Code d'autorisation | Code d'autorisation du système de paiement international (6 caractères). |

| ID Terminal | Identifiant du terminal dans le système traitant le paiement. |

| Code unique d'opération (RRN) | Identifiant unique de la transaction bancaire. |

| Montant du paiement | Montant du paiement. |

| Commission de paiement | Montant de la commission pour le paiement (si applicable). |

| Montant total du paiement | Montant du paiement avec commission incluse. |

| Numéro de carte | Numéro masqué de la carte utilisée pour le paiement. |

| Date d'expiration de la carte | Date d'expiration de la carte utilisée pour le paiement. |

Pour retourner à la boutique, le client doit cliquer sur le lien Retourner à la boutique.

Vous pouvez activer ou désactiver l'affichage de la page finale en cochant la case Afficher la page finale sur la page Paramètres généraux de votre espace personnel. Pour plus de détails, lisez ici.

Envoi en masse de factures de paiement

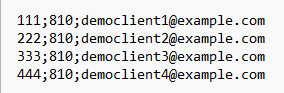

Si vous disposez de l'autorisation correspondante, vous pouvez envoyer plusieurs factures de paiement aux clients en une fois, en téléchargeant un fichier au format CSV avec les données des factures et les adresses e-mail. Le format du fichier est défini par un modèle configuré par l'équipe de support.

Exemple de contenu du fichier (montant de l'opération, codes de devise, e-mail) :

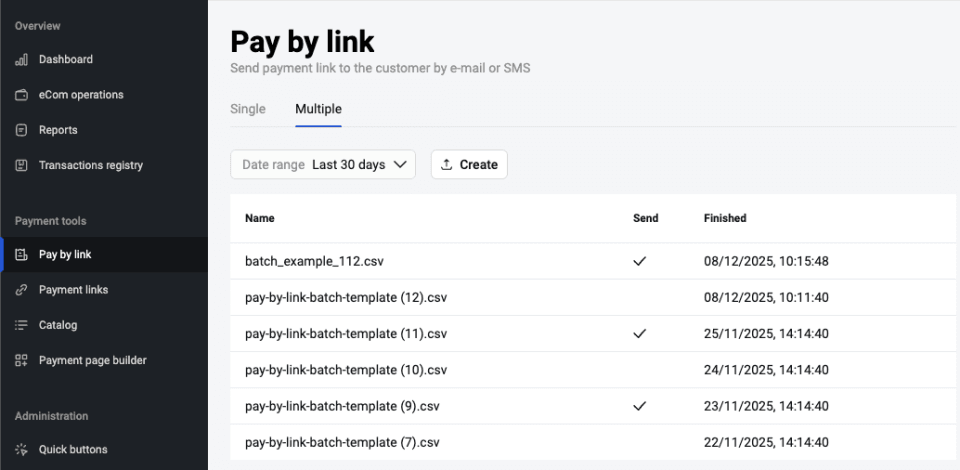

Téléchargement du fichier pour l'envoi

Pour télécharger le fichier pour l'envoi :

-

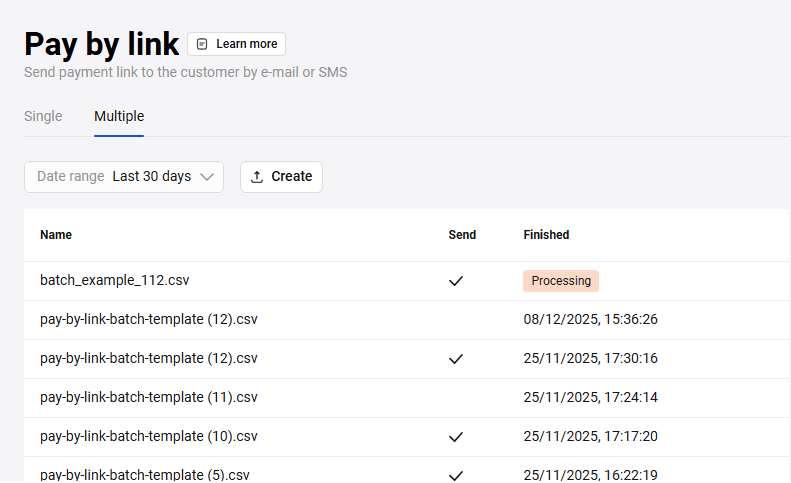

Allez dans la section Facture de paiement et ouvrez l'onglet Plusieurs. La page affiche la liste des fichiers téléchargés précédemment (s'il y en a).

-

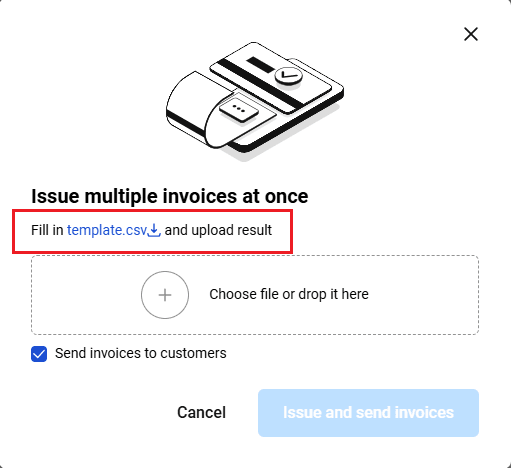

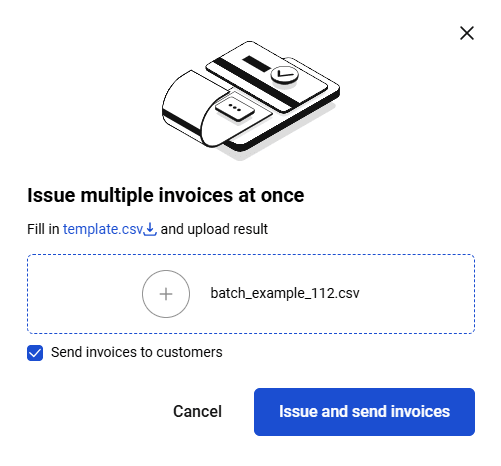

Cliquez sur Créer. Une boîte de dialogue s'ouvre où vous pouvez télécharger le modèle pour créer le fichier. Téléchargez le modèle et remplissez-le avec les valeurs nécessaires.

-

Sélectionnez ou faites glisser dans le champ correspondant le fichier à télécharger. Si vous souhaitez que les liens de paiement soient envoyés aux clients immédiatement après le téléchargement, cochez la case Envoyer les factures aux clients, puis cliquez sur Créer et envoyer les liens. Si vous souhaitez simplement créer les liens sans les envoyer, décochez la case Envoyer les factures aux clients et cliquez sur Créer les liens.

-

Dans la liste des fichiers traités, une nouvelle ligne avec le fichier téléchargé apparaîtra. Pendant que le fichier est en cours de formation, la colonne Terminé affiche le statut "En cours". Lorsque le fichier sera traité, cette colonne affichera la date et l'heure de fin du traitement du fichier. Dans la colonne Envoyé, une coche s'affiche si les liens de paiement ont été envoyés aux clients.

Affichage des détails du fichier traité

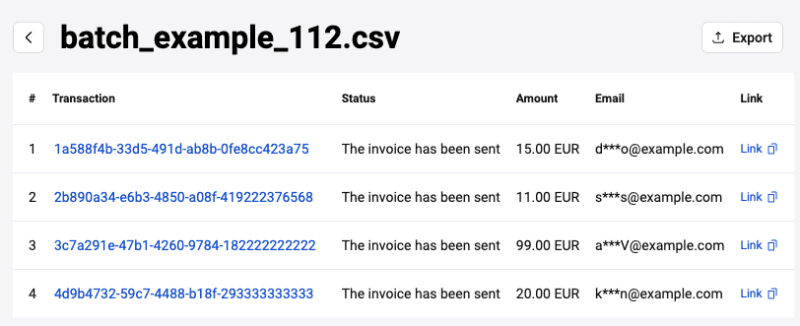

Pour afficher le contenu du fichier traité pour l'envoi, allez dans la section Facture de paiement, ouvrez l'onglet Plusieurs et cliquez sur la ligne du fichier téléchargé. Une page avec les détails de chaque facture s'ouvrira.

Le tableau contient les colonnes suivantes avec les détails de chaque facture :

- Transaction — lien vers la transaction pour cette facture

- Statut — statut d'envoi de la facture au client

- Montant — montant de la transaction

- E-mail - adresse de courrier électronique pour l'envoi de la facture

- Lien — lien vers la page de paiement

Export du fichier traité

Pour exporter le fichier traité, allez dans les détails du fichier et cliquez sur le bouton Export. Le fichier sera exporté au format CSV avec les champs suivants :

-

itemId— champ obligatoire, numéro d'ordre de la ligne traitée du fichier -

successful— champ obligatoire, succès du traitement de la ligne (true / false) -

reason— champ obligatoire, description de l'erreur (si il n'y a pas d'erreurs, ce champ est vide) -

link— champ obligatoire, lien généré pour le paiement -

email— adresse de courrier électronique qui a été indiquée lors du téléchargement (si ce paramètre a été défini dans le modèle)

Dans le fichier de sortie, il peut y avoir d'autres champs s'ils ont été définis dans le modèle.

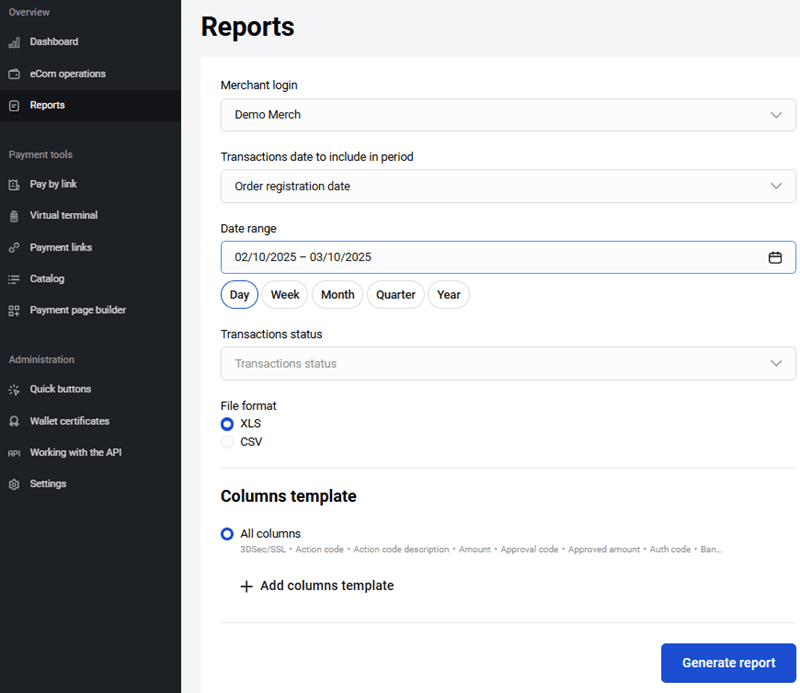

Rapports

La section Rapports permet de générer des rapports sur les transactions, en se basant sur de multiples paramètres au choix. Pour afficher la page Rapports, cliquez sur l'icône ![]() dans le panneau latéral gauche.

dans le panneau latéral gauche.

Sélectionnez le login du vendeur pour les transactions duquel vous souhaitez construire un rapport. Plusieurs logins peuvent être disponibles si vous avez l'autorisation de consulter les transactions d'autres vendeurs ou s'il y a des vendeurs enfants.

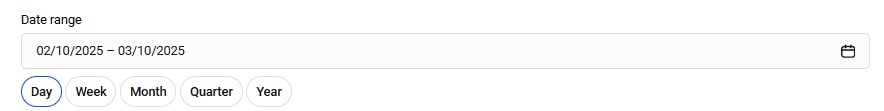

La page présente plusieurs filtres pour la génération. Vous pouvez sélectionner les transactions par date :

- Date de création

- Date de retour

- Date de finalisation

- Date de paiement

- Date d'annulation

Définissez la période nécessaire pour l'examen (Jour, Semaine, Mois, Trimestre, Année) ou choisissez une période spécifique avec des dates à l'aide du calendrier.

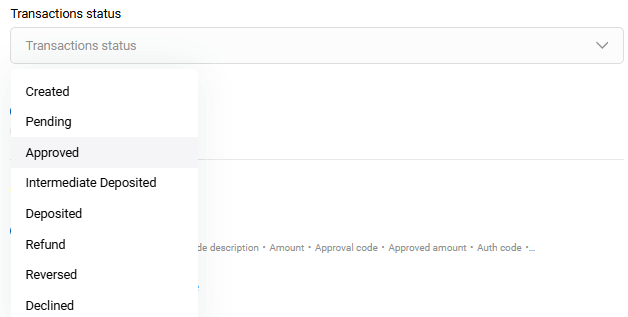

Vous pouvez également filtrer les transactions par leur statut.

Le rapport peut être exporté dans un fichier au format .xls ou .csv. Choisissez le format en cliquant sur les boutons correspondants.

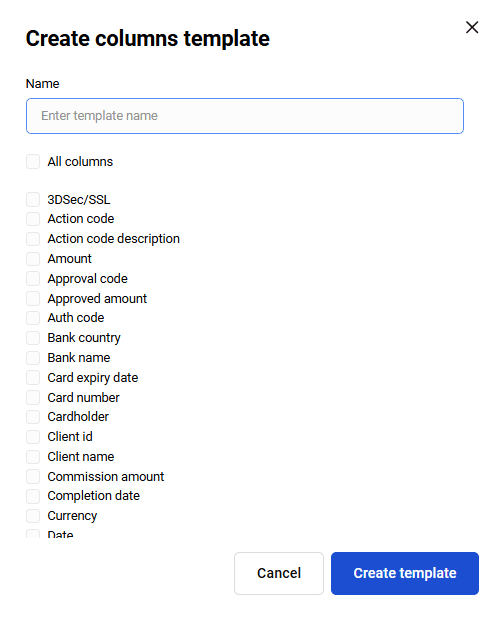

En utilisant le bouton Ajouter un modèle de colonnes, vous pouvez créer un modèle de champs pour une utilisation ultérieure dans les rapports. Après avoir appuyé sur le bouton, un formulaire de configuration des colonnes apparaîtra. Saisissez le nom du modèle et cochez les colonnes qui doivent être affichées dans le rapport. Certaines colonnes sont interconnectées pour la commodité de l'utilisateur :

- Devise : automatiquement cochée lors de la sélection de tout montant (y compris le montant de retour, le montant à confirmer, le montant de commission, le montant de confirmation, le montant de pré-autorisation).

- Statut : automatiquement coché lors de la sélection de certaines dates (annulation, dernier retour, débit).

Après la sélection des colonnes, cliquez sur Créer le modèle.

Le modèle sauvegardé sera disponible pour la sélection dans la liste Modèle de colonnes.

Après avoir défini les paramètres souhaités, cliquez sur le bouton Générer le rapport. La formation du rapport dans le format défini commencera. Selon les paramètres de votre navigateur, le fichier du rapport sera sauvegardé ou une boîte de dialogue pour sauvegarder le fichier apparaîtra.

Liens de paiement

Vous pouvez créer des modèles de liens de paiement qui redirigeront le client vers la page de paiement.

Création d'un lien de paiement

Pour créer un lien vers la page de paiement, accédez à votre compte personnel, dans le panneau latéral gauche sélectionnez Liens de paiement, puis cliquez sur Créer :

Vous pouvez également créer un lien de paiement en cliquant sur le bouton Créer en haut de votre compte personnel et en sélectionnant Lien de paiement.

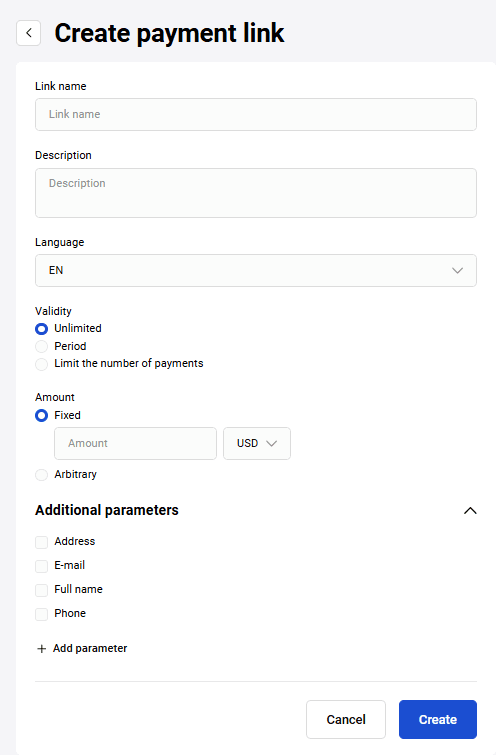

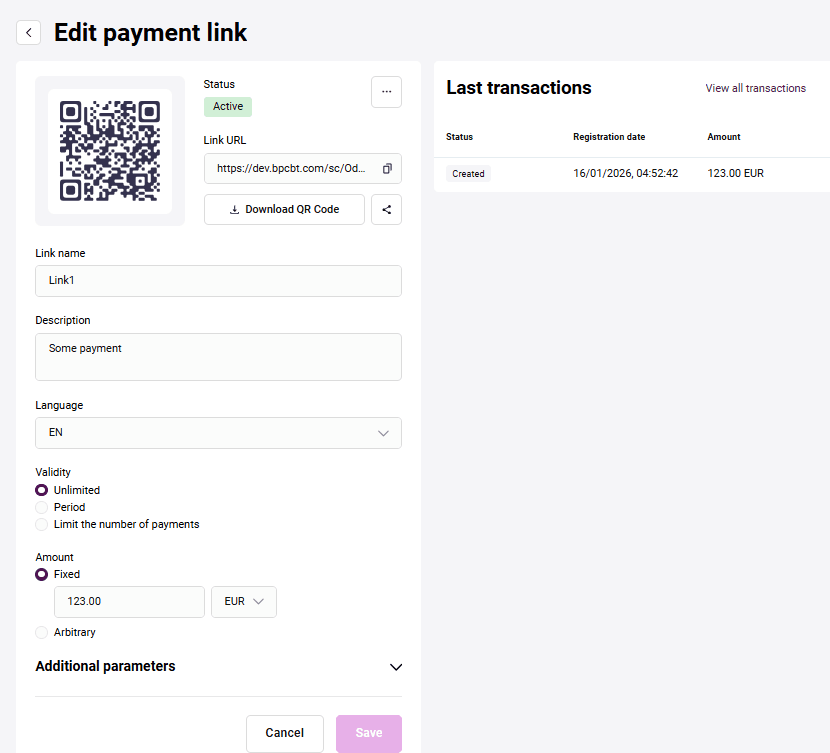

Un formulaire à remplir apparaîtra :

Remplissez les champs nécessaires en vous guidant du tableau ci-dessous.

| Caractère obligatoire | Champ | Description |

|---|---|---|

| Obligatoire | Nom du lien | Nom du lien qui n'est visible que par le vendeur |

| Facultatif | Description | Description de la commande qui n'est visible que par le vendeur |

| Par défaut | Type de paiement | Type d'opération de paiement. Valeurs disponibles : Une étape (PURCHASE)/Deux étapes (PRE_AUTH). Par défaut, le paiement en une étape est sélectionné. Pour que ce champ s'affiche, le paiement en deux étapes doit être activé (contactez le support technique) |

| Par défaut | Langue | Langue de la page de paiement. Valeurs disponibles : FR/EN |

| Facultatif | Montant à payer | Saisissez le montant à payer. En sélectionnant l'option "N'importe quel", l'acheteur peut spécifier le montant à payer sur la page de paiement |

| Par défaut | Devise | Défini par défaut, la valeur est établie selon les paramètres du marchand |

| Facultatif | Action | Spécifiez la période de validité du lien : pour cela, sélectionnez Période et spécifiez les dates de début et de fin souhaitées du lien depuis le calendrier déroulant. Vous pouvez également limiter le nombre de paiements en sélectionnant l'option correspondante. Si l'option Illimité est sélectionnée, ce champ n'est pas disponible à la modification |

Si nécessaire, remplissez les paramètres supplémentaires dans la section Paramètres supplémentaires.

| Champ | Description |

|---|---|

| Adresse | Afficher ou non le champ d'adresse de livraison sur la page de pré-paiement |

| Courrier électronique | Afficher ou non le champ de saisie de l'e-mail du client sur la page de pré-paiement |

| Nom et prénom | Afficher ou non le champ de saisie du nom et prénom du client sur la page de pré-paiement |

| Téléphone | Afficher ou non le champ de saisie du numéro de téléphone du client sur la page de pré-paiement |

Il y a aussi la possibilité d'ajouter vos propres paramètres. Pour cela, cliquez sur Ajouter un paramètre et remplissez les champs :

| Champ | Description |

|---|---|

| Titre | Nom du paramètre que voit le client |

| Dénomination | Requis pour la passerelle de paiement. Seuls les caractères latins et les caractères de soulignement sont autorisés. Par exemple : size, items_count etc. |

| Signature | Indication pour le client avec un exemple de remplissage du champ |

| Expression régulière | Expression régulière, utilisée pour la vérification des données d'entrée |

| Valeur | Données pré-remplies dans le champ. Le client ne pourra pas modifier cette valeur |

| Champ obligatoire | Case à cocher qui doit être cochée si le nouveau paramètre est obligatoire pour le client |

| Visible par le client | Case à cocher qui doit être cochée si le nouveau paramètre s'affiche sur la page de pré-paiement. |

| Imprimable | Case à cocher qui doit être cochée si le nouveau paramètre s'affiche dans le reçu PDF. |

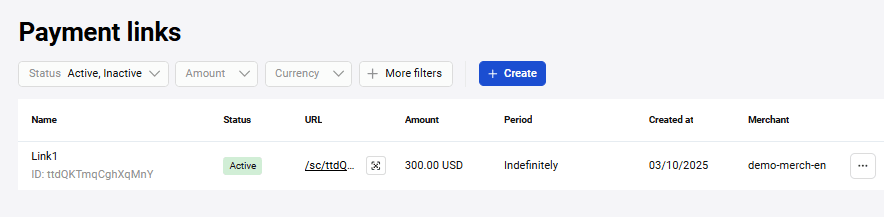

Après avoir rempli tous les champs nécessaires, cliquez sur Créer en bas du formulaire. Le lien s'affichera ensuite sur la page principale avec le statut Actif :

Actions possibles avec le modèle de lien de paiement

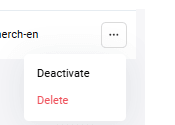

En cliquant sur l'icône ![]() les actions suivantes sont disponibles avec le lien de paiement :

les actions suivantes sont disponibles avec le lien de paiement :

-

Partager le lien — cliquez sur Partager.

-

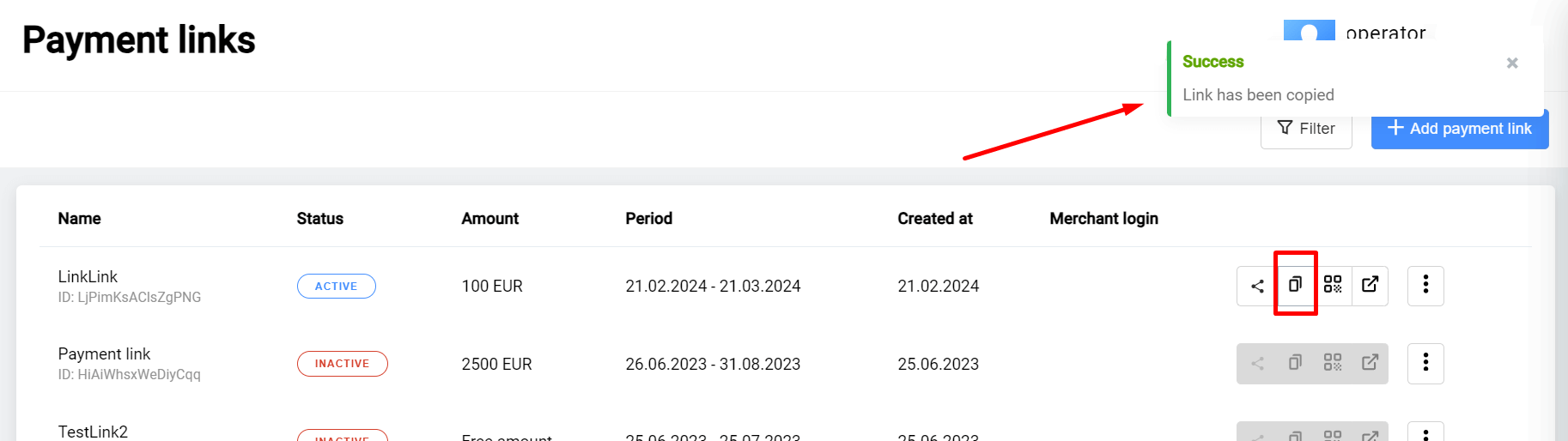

Copier le lien - cliquez sur l'icône de copie. Une notification apparaîtra indiquant que le lien a été copié avec succès.

-

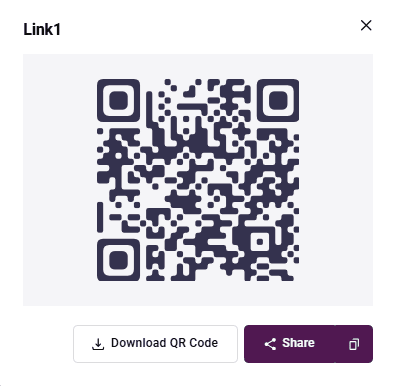

Créer un code QR — vous verrez le code QR généré, ainsi que vous pourrez télécharger son image dans le format choisi, en cliquant sur Télécharger le code QR.

De plus, les actions suivantes sont disponibles :

-

Désactivation/activation et suppression — disponibles en cliquant sur l'icône à trois points dans la ligne du lien.

Modification — cliquez sur le lien souhaité pour voir les détails du lien créé et le modifier. Pour effectuer les actions décrites ci-dessus, vous pouvez également utiliser les boutons correspondants sur cette page.

-

Filtre — pour former une autre sélection de liens de paiement, cliquez sur Plus de filtres en haut de la page Liens de paiement. Une page pour sélectionner les filtres s'ouvrira :

Sélectionnez les critères de recherche nécessaires et cliquez sur Appliquer dans la fenêtre du filtre. Pour effacer tous les champs du filtre, cliquez sur le bouton Réinitialiser les filtres.

Vous pouvez rechercher selon les paramètres suivants :

- Vendeur — Si nécessaire, sélectionnez un vendeur dans la liste des vendeurs disponibles dont les liens de paiement doivent être sélectionnés

- Nom — nom du lien que vous avez indiqué lors de la création du lien

- Identifiant du lien — identifiant du modèle de lien de paiement

- Statut — trois statuts de lien sont possibles : "Active"/"Inactive"/"Supprimée". Notez que les liens supprimés ne s'affichent pas dans le tableau, sauf si le statut "Supprimée" est explicitement sélectionné dans le filtre

- Montant de - Montant à — Montant de la commande (ces champs ne sont pas disponibles pour modification si l'option N'importe quel montant est activée)

- Devise — sélectionnez la devise dans la liste déroulante

- N'importe quel montant — activez l'option si le montant comme critère de recherche n'est pas important

- Période de validité — durée de validité établie pour le lien. Cliquez sur les dates et sélectionnez dans le calendrier la date de début et la date d'expiration de la validité (champ non disponible pour modification si l'option Permanent est activée)

- Permanent — activez l'option si la durée de validité du lien comme critère de recherche n'est pas importante

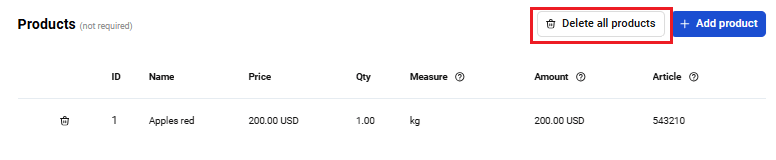

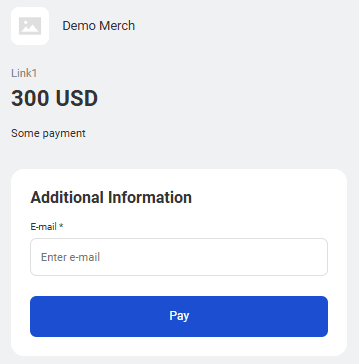

Page de pré-paiement / Page de paiement

Si lors de la création du lien des paramètres supplémentaires ont été indiqués (E-mail/Nom complet/Téléphone/Adresse) ou si le champ du montant du paiement a été laissé vide, après l'ouverture du lien de paiement le client doit remplir les champs obligatoires sur la page de pré-paiement et seulement ensuite procéder au paiement de la commande.

Exemple de page de pré-paiement avec des paramètres supplémentaires :

Exemple de page de paiement :

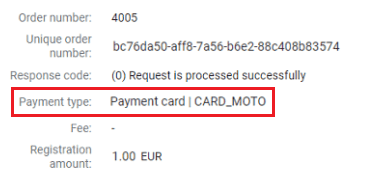

Paiement MOTO

Vous pouvez utiliser les paiements MOTO (Mail Order/Telephone Order) - paiements initiés par les clients via appel téléphonique, courrier, etc., qui permettent aux clients d'acheter à distance des biens et services en fournissant les données de leur carte.

Créez un paiement MOTO

Pour créer un paiement MOTO, effectuez les actions suivantes :

-

Accédez à la section Terminal virtuel de l'Espace personnel. La page de saisie des paramètres de facture de paiement s'ouvre :

-

Remplissez les champs nécessaires en vous guidant par le tableau ci-dessous.

Paramètre Description Numéro de commande Numéro de commande dans le système du magasin (champ non disponible pour modification si le vendeur a l'autorisation correspondante dans le système et que le système génère lui-même le numéro de commande). Description du paiement Description du paiement sous forme libre. Magasin Si nécessaire, sélectionnez le vendeur dans la liste des vendeurs disponibles. Devise Sélectionnez la devise dans la liste déroulante (champ présent si plus d'une devise est définie pour le marchand). Saisissez le montant Saisissez le montant de la commande. Autorisation/Pré-autorisation Choisissez l'une des deux options. - Autorisation - Paiement en une étape : après traitement du paiement, aucune action supplémentaire de votre part n'est requise.

- Pré-autorisation - Paiement en deux étapes : après que le client a confirmé le paiement, il est nécessaire de finaliser le paiement dans l'Espace personnel. Jusqu'à ce que vous le fassiez, l'argent sera retenu sur le compte du client (en attente) jusqu'au moment de la confirmation du paiement par vous ou jusqu'à l'expiration du délai d'attente de confirmation.

En cas de confirmation du paiement par vous, l'argent est transféré sur votre compte.

En cas d'expiration du délai d'attente de confirmation, le blocage des fonds sur le compte du client est levé.

ID client Numéro du client dans le système de votre magasin. Numéro de carte Numéro masqué de la carte utilisée pour le paiement. Date d'expiration Date d'expiration de la carte du payeur. Titulaire de la carte Nom du titulaire de la carte indiqué lors de l'enregistrement de la commande. Cliquez sur le bouton Envoyer.

Dès que le paiement MOTO sera effectué, les informations détaillées à son sujet s'affichent sur la page Transactions.

Si le paiement MOTO est en deux étapes, vous devez le finaliser. Comment procéder est décrit ici.

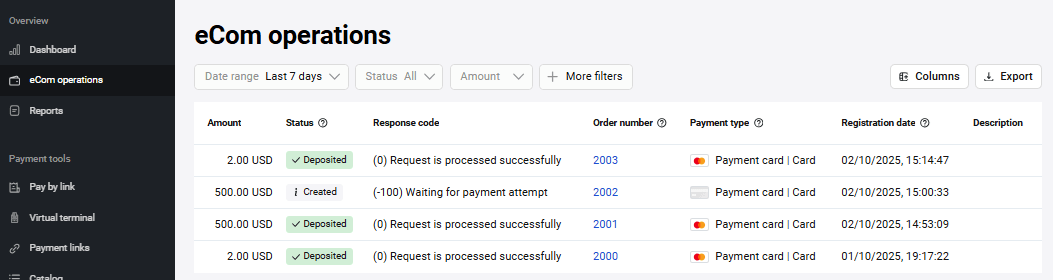

Travail avec les transactions

La page Transactions contient des informations détaillées sur les commandes et les paiements. Pour accéder à la page, cliquez sur le bouton ![]() dans le panneau latéral gauche.

dans le panneau latéral gauche.

Dans la partie supérieure de la page Transactions se trouve une zone de recherche permettant de définir les critères d'affichage des transactions. La liste sur la page contient les transactions répondant aux critères de recherche.

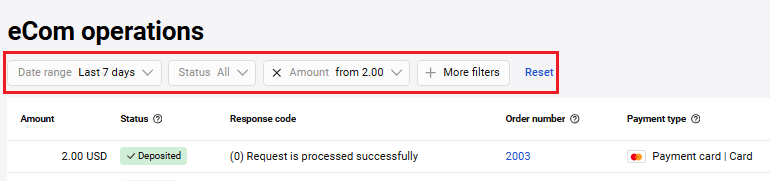

Recherche de transactions à l'aide du filtre

Pour travailler avec les transactions, il est nécessaire de définir et d'appliquer d'abord les critères de recherche.

Pour définir les critères de recherche des transactions, effectuez les actions suivantes.

- Dans l'espace personnel, accédez à la page Transactions.

- Dans la zone de recherche en haut, définissez les paramètres nécessaires. Pour ajouter plus de critères de recherche, cliquez sur Plus de filtres, ajoutez les filtres nécessaires et cliquez sur Appliquer.

Les transactions correspondant aux conditions s'afficheront dans la liste.

Pour répéter la recherche de transactions par la suite, vous pouvez copier le lien de recherche depuis la barre d'adresse ou l'ajouter aux favoris dans le navigateur.

Pour réinitialiser les filtres, cliquez sur Réinitialiser.

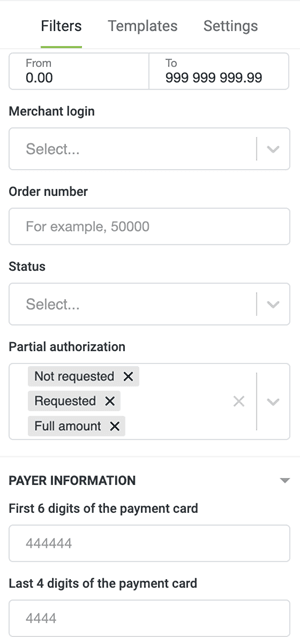

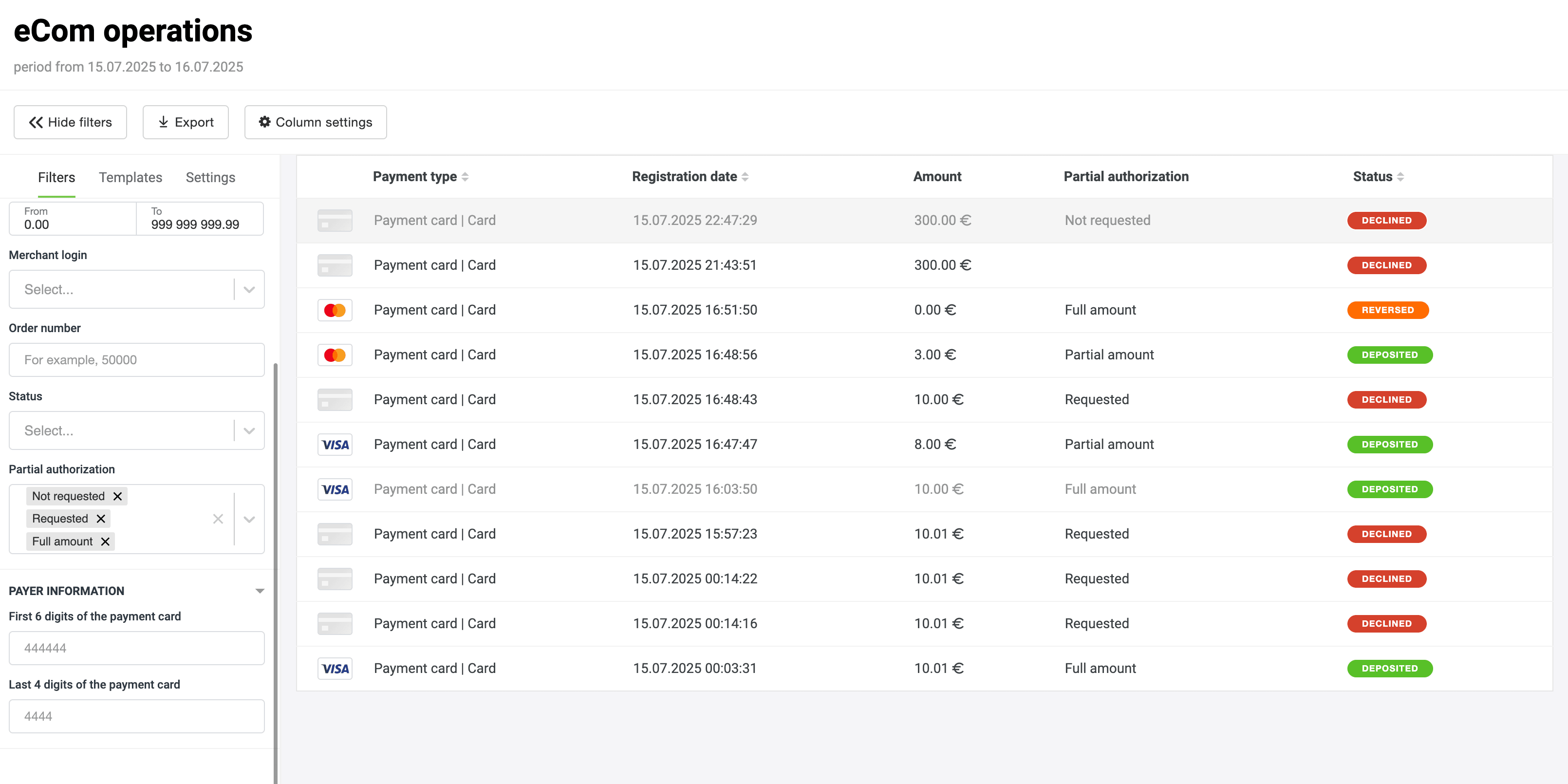

Paramètres du filtre de transactions

Le filtre permet de définir les critères de sélection des transactions effectuées.

-

Plage de dates — Dans la première liste déroulante, indiquez selon quelle date effectuer la sélection. Par exemple, Date de création. Dans la deuxième liste déroulante, indiquez le type de définition d'intervalle temporel :

-

Plage de dates — permet de définir un intervalle temporel en choisissant dans le calendrier les dates de début et de fin ;

-

Période — permet de choisir pour quelle période actuelle seront affichées les transactions : jour, semaine, mois ou année.

-

Plage de dates — permet de définir un intervalle temporel en choisissant dans le calendrier les dates de début et de fin ;

- Montant — Montant de la commande. Indiquez les limites supérieure et inférieure de la plage.

-

Statut — Statut de la commande. Les statuts suivants sont disponibles (choix multiple) :

-

Créé. Facture émise, mais pas encore payée.

-

Confirmé. Facture payée. Les fonds sont réservés sur le compte du payeur.

-

Terminé. Les fonds sont débités du compte du payeur.

-

Annulé. Tous les fonds sont retournés au payeur.

-

Rejeté. Facture émise, mais pas payée à temps.

- Remboursement. Remboursement partiel effectué.

-

Créé. Facture émise, mais pas encore payée.

- Numéro de commande — Numéro automatiquement attribué à la commande dans le magasin. Si vous devez trouver une commande spécifique, indiquez ici son numéro.

- Login du vendeur — Login du vendeur dans le système de passerelle de paiement. Indiquez votre login (affiché dans le coin supérieur droit).

- 4 derniers chiffres de la carte — Quatre derniers chiffres du numéro de carte du payeur utilisée pour le paiement de la commande. Si vous recherchez des transactions par carte spécifique et connaissez son numéro, indiquez ici ses quatre derniers chiffres.

-

Autorisation partielle — statut d'autorisation partielle de la commande. Valeurs admissibles :

- Non demandé — Le marchand n'a pas demandé d'autorisation partielle.

- Demandé — Le marchand a demandé une autorisation partielle, mais l'autorisation n'a pas encore été effectuée.

- Montant partiel — Le marchand a demandé une autorisation partielle. L'autorisation partielle a été exécutée avec succès en cas d'insuffisance du solde du client.

- Montant complet — Le marchand a demandé une autorisation partielle, mais le solde du client était suffisant, de sorte que l'exécution de l'autorisation partielle n'a pas été nécessaire et le montant complet a été débité.

Description des autres critères de recherche voir ici.

Tableau des transactions

Le tableau des transactions se trouve sur la page Transactions. Les transactions apparaissent dans le tableau après que le filtre soit appliqué.

Par défaut, le tableau contient les colonnes suivantes avec les attributs des transactions :

- Montant — Montant de la commande.

- Autorisation partielle — Statut d'autorisation partielle.

- Statut — Statut de la commande.

- Code de réponse — Code numérique du résultat obtenu du traitement bancaire (action code). Voir la liste des codes de réponse ici.

- Numéro de commande — Numéro de commande dans le système du magasin.

- Moyen de paiement — Moyen de paiement qui a été utilisé pour le paiement de la commande.

- Date d'enregistrement — Date à laquelle la transaction a été enregistrée.

- Description de la commande — Description arbitraire des marchandises et services.

Export de la liste des transactions

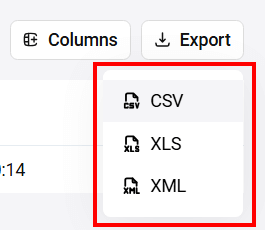

Dans certains cas, vous pourriez avoir besoin d'exporter vos transactions. Trois formats sont disponibles : XLS, CSV et XML. Pour cela :

- Trouvez les commandes nécessaires en spécifiant les critères de recherche nécessaires à l'aide du filtre.

- Cliquez sur le bouton Export, choisissez un des trois formats proposés pour la sauvegarde : XLS, CSV et XML.

- La formation du rapport dans le format donné commencera. Selon les paramètres de votre navigateur, le fichier de rapport sera sauvegardé ou une boîte de dialogue pour sauvegarder le fichier prêt apparaîtra.

Informations détaillées sur la transaction

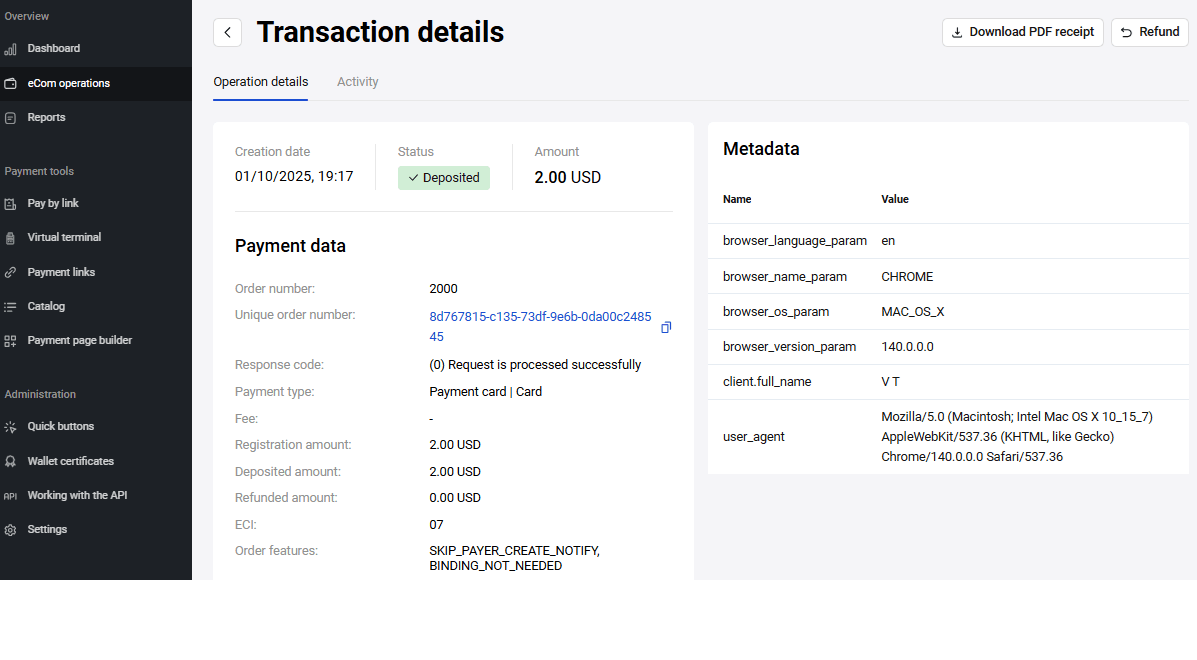

Dans le compte personnel, des informations détaillées sur chaque paiement sont disponibles.

Pour en savoir plus sur le paiement, en étant sur la page Transactions, cliquez sur la ligne de la transaction qui vous intéresse dans le tableau.

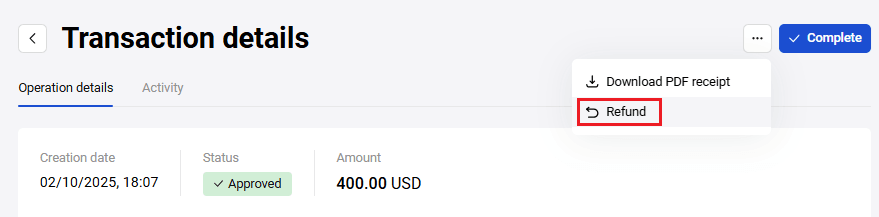

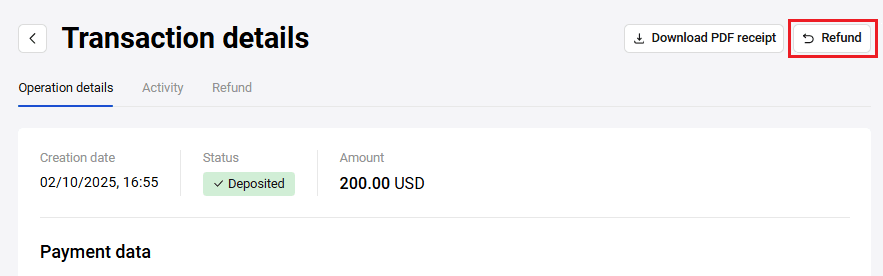

La page Détails de la transaction s'ouvrira. Elle contient toujours les onglets Détails de l'opération et Activité.

Pour les transactions d'un type déterminé, l'onglet Remboursement peut s'afficher en plus.

Aussi, selon le statut et le type de transaction, les boutons Finaliser et Remboursement peuvent s'afficher.

Le bouton Finaliser permet de confirmer le paiement en deux étapes du client. Ce bouton est actif seulement quand la commande obtient le statut Confirmé.

Le bouton Remboursement permet de rembourser complètement ou partiellement les fonds au client. La fonctionnalité du bouton dépend du statut de la commande et de la présence d'un panier de produits :

- Dans les commandes avec panier de produits au statut Confirmé, cliquer sur le bouton Remboursement ouvre l'onglet Remboursement, où on peut choisir les positions de produits à rembourser ou rembourser toute la somme de la commande.

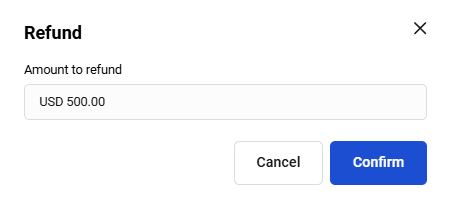

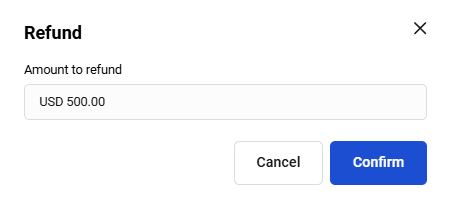

- Dans toutes les autres commandes, cliquer sur le bouton Remboursement ouvre la fenêtre de remboursement, où seule la valeur de la somme est indiquée.

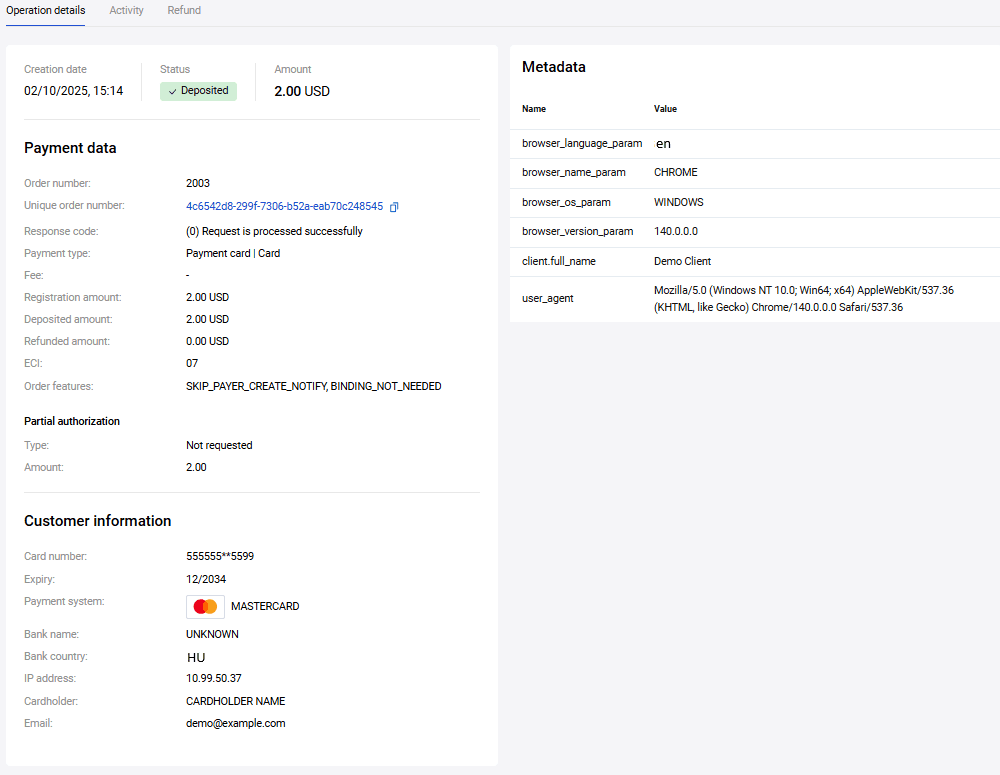

Détails de l'opération

L'onglet Détails de l'opération contient les sections suivantes :

- Données de paiement. Cette section montre les attributs de paiement de la transaction.

- Informations sur le client. Ici sont présentées les informations sur le moyen de paiement et son propriétaire.

- Métadonnées. Paramètres techniques supplémentaires.

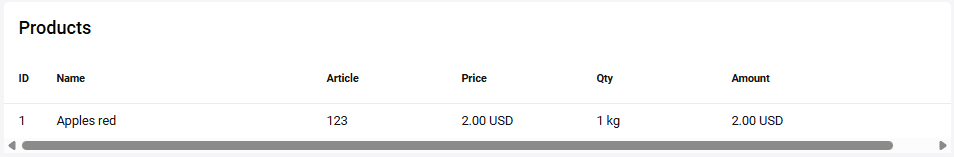

Produits. Informations sur les produits ou services payés dans le cadre de la transaction (s'affiche seulement si un panier de produits était présent dans la commande).

Événements. Suivi détaillé des actions du client sur la page de paiement.

La section Détails de l'opération contient les champs suivants :

| Champ | Description |

|---|---|

| Numéro de commande | Numéro de commande dans le système de boutique. |

| Numéro unique de commande dans le système | Identifiant de commande dans la passerelle de paiement. |

| Code de réponse | Code numérique du résultat obtenu du processing de la banque (action code). Voir la liste des codes de réponse ici. |

| Moyen de paiement | Moyen de paiement qui a été utilisé pour le paiement de la commande. |

| Commission | Montant de la commission, si une commission était prélevée. |

| Montant d'enregistrement | Montant de la commande. |

| Montant confirmé | Montant de blocage (pour les commandes en deux étapes). |

| Montant de débit | Montant qui a été finalement débité. |

| Montant à rembourser | Montant de remboursement, si un remboursement était effectué. |

| Date de création | Date et heure de création de la commande. |

| ECI |

Electronic Commerce Indicator. Valeurs possibles :

|

| Description de la commande | Description arbitraire des produits et services |

La section Informations sur le client contient les champs suivants :

| Champ | Description |

|---|---|

| Numéro de carte | Numéro masqué de la carte utilisée pour le paiement. |

| Adresse IP | Adresse IP du payeur. |

| Date d'expiration | Date d'expiration de la carte du payeur. |

| Système de paiement | Nom du système de paiement international auquel appartient la carte du payeur. |

| Nom du titulaire de la carte | Nom du titulaire de la carte indiqué lors de l'enregistrement de la commande. |

| Adresse e-mail du payeur. |

La section Produits contient des informations sur les produits ou services payés dans le cadre de la transaction.

| Colonne | Description |

|---|---|

| Code | Numéro de l'article dans le panier. |

| Désignation | Désignation de l'article. |

| Référence | Identification numérique ou alphabétique destinée à la classification de l'article. |

| Prix | Prix par unité de l'article. |

| Qté | Quantité d'unités de l'article. |

| Montant | Montant total pour toutes les unités d'un même article (calculé automatiquement). |

| Remboursement | Informations sur le remboursement des fonds. S'affiche uniquement s'il y a eu un remboursement. |

La section Autorisation partielle contient les champs suivants :

| Champ | Description |

|---|---|

| Type | Type d'autorisation partielle. Valeurs autorisées :

|

| Somme | Somme d'autorisation. |

La section Événements affiche les actions que le client effectue pendant le processus de paiement, par exemple "Page de paiement ouverte", "Focus perdu", "Transition vers le champ du numéro de carte", etc. Cela vous permettra de comprendre le comportement du client et, ainsi, de rendre le processus de paiement plus compréhensible et pratique.

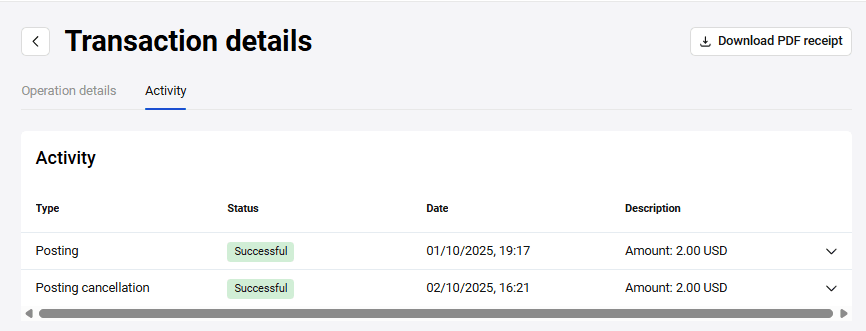

Activité

L'onglet Activité contient des informations sur tous les événements de la commande : crédits de paiement, remboursements, etc.

| Colonne | Description |

|---|---|

| Type | Opérations entreprises dans le processus de travail avec la commande |

| Statut | Statut de l'opération |

| Date | Date de réalisation de l'opération |

| Description | Somme de la commande |

Remboursement

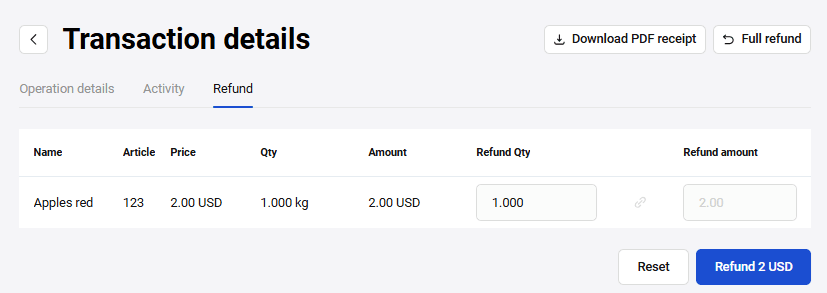

L'onglet Remboursement contient des informations sur les positions de marchandises dans la commande et permet d'effectuer un remboursement au payeur.

Il est possible de rembourser toute la somme entièrement ou d'effectuer un remboursement pour certaines positions de marchandises.

Remboursement complet par transaction

Pour effectuer un remboursement complet au payeur pour la commande, effectuez les actions suivantes :

En étant sur l'onglet Remboursement, cliquez sur le bouton Remboursement complet. La commande passera au statut Annulé ou Remboursement, selon le stade du paiement et la date d'exécution du remboursement.

Remboursement par articles

Pour rembourser les fonds par articles, effectuez les actions suivantes :

-

En étant sur l'onglet Remboursement, utilisez le tableau avec la composition du panier.

Colonne Description Code Numéro de l'article dans le panier. Dénomination Dénomination de l'article. Référence Désignation numérique ou alphabétique, destinée à la classification de l'article. Prix Prix par unité d'article. Quantité Nombre d'unités d'article. Somme Somme totale pour toutes les unités d'un article (calculée automatiquement). Quantité à rembourser Nombre d'unités de marchandise qu'il faut retourner. Somme à rembourser Somme qui sera remboursée. Champ calculé automatiquement. Dans le champ Quantité à rembourser indiquez le nombre d'unités de marchandise à annuler. La somme remboursée s'affichera dans le champ Somme à rembourser.

Cliquez sur le bouton Remboursement.

Si la somme de remboursement est inférieure à la somme de la commande, la commande passera au statut Remboursement. Si la somme complète de la commande est remboursée, la commande passera au statut Annulé.

Actions disponibles sur la page de transaction

Actions principales avec les transactions dans l'espace personnel :

Ces opérations sont appelées par les boutons correspondants sur la page d'informations sur la transaction. Voir ci-dessous la description détaillée de chaque opération.

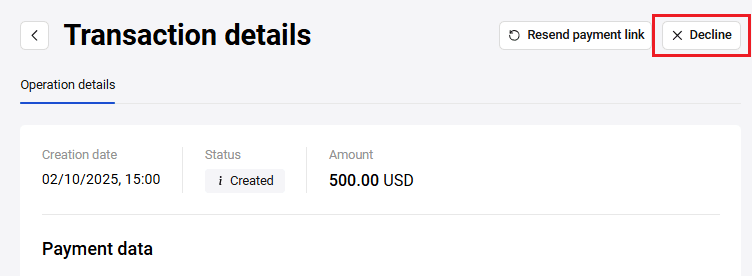

Annulation de commande

Habituellement, une commande qui n'a pas été payée ou pré-autorisée est automatiquement annulée après un certain temps défini dans le système, par exemple, après 20 minutes. Mais cette opération peut également être effectuée manuellement depuis l'espace personnel du vendeur.

Si vous souhaitez annuler une commande avant le paiement ou l'autorisation préalable, vous pouvez le faire en cliquant sur le bouton Rejeter sur la page d'informations sur la transaction.

Après l'annulation, la commande obtient le statut Rejetée.

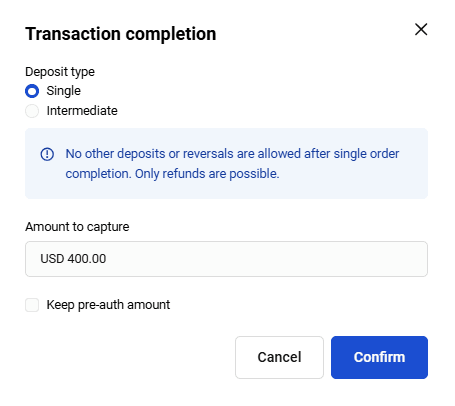

Finalisation de commande

Lors d'un paiement en deux étapes, les fonds sont d'abord gelés sur le compte du client (statut de la commande — Confirmée) et ensuite seulement crédités sur le compte du vendeur (statut de la commande — Finalisée). Il est possible de configurer pour que le transfert final se produise automatiquement après un certain temps défini dans le système, par exemple, après 24 heures. Mais cette opération peut être effectuée manuellement depuis l'espace personnel du vendeur.

Pour finaliser la transaction, sur la page Informations sur la transaction, cliquez sur le bouton Finaliser.

Une fenêtre de confirmation s'ouvrira. Son apparence est montrée ci-dessous et dépend de l'utilisation ou non d'un panier de produits dans la commande.

Si le panier N'est PAS utilisé, la fenêtre de confirmation ressemble à ceci :

Vérifiez la valeur dans le champ et cliquez sur le bouton Confirmer.

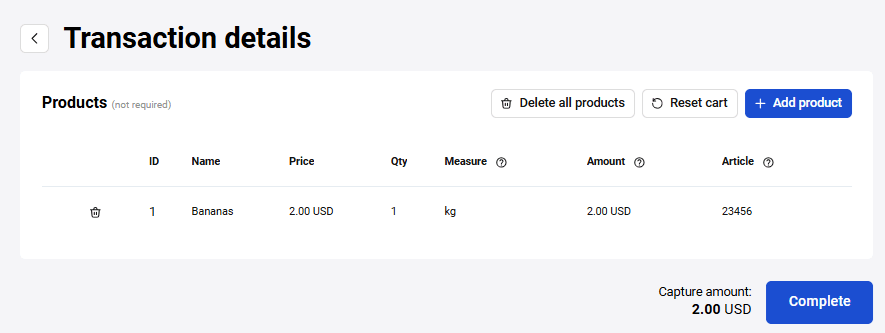

Si le panier est utilisé, la fenêtre de confirmation ressemble à ceci :

Vérifiez les données, modifiez-les si nécessaire et cliquez sur le bouton Finaliser. Après finalisation, la commande obtient le statut Finalisée.

Avec la permission correspondante, vous pouvez apporter des modifications au panier de sorte que le montant de finalisation dépasse le montant de pré-autorisation. Le pourcentage de dépassement du montant du dépôt peut être quelconque — il est défini par un certain paramétrage. Pour activer cette possibilité, contactez le service de support technique.

Par exemple, dans les paramètres est défini un pourcentage de dépassement du montant du dépôt — 100%. Dans le formulaire de paiement vous avez facturé un montant de 2700 roubles. Alors il est possible de modifier le panier de sorte que le montant de la commande ne dépasse pas 5400 roubles. En cas de dépassement, une erreur s'affichera et le bouton Finaliser deviendra indisponible :

Annulation de commande confirmée

Dans l'espace personnel, vous pouvez annuler les paiements pour les transactions en deux étapes avec le statut Confirmée (quand les fonds sont réservés sur le compte du client, mais pas encore crédités). L'annulation signifie que la transaction est annulée, et tous les fonds réservés sur le compte du client sont débloqués.

Pour annuler le paiement, sur la page d'informations sur la transaction, cliquez sur le bouton Remboursement.

La fonctionnalité du bouton dépend du statut de la commande et de la présence d'un panier de produits : Si le statut de la commande est Confirmée et qu'il n'y a pas de panier de produits, alors une fenêtre de confirmation du remboursement s'ouvre.

Si vous saisissez seulement une partie du montant, le montant indiqué sera remboursé, et la commande restera dans le statut Confirmée. Si vous saisissez le montant total, la commande passera au statut Annulée.

Dans la fenêtre de confirmation, cliquez sur Confirmer.

Remboursement

Depuis l'espace personnel, vous pouvez effectuer un remboursement pour les transactions effectuées (commandes payées par les clients qui se trouvent dans le statut Terminée). Pour les paiements en deux étapes, le statut Terminée signifie que les fonds, se trouvant sur la carte du payeur, ont déjà été débités.

Le remboursement s'effectue sur la page d'informations sur la transaction à l'aide du bouton Remboursement.

La fonctionnalité du bouton dépend du statut de la commande et de la présence d'un panier de produits :

- Dans les commandes avec panier de produits dans le statut Confirmée, cliquer sur le bouton Remboursement ouvre l'onglet Remboursement, où vous pouvez sélectionner les positions de produits à rembourser ou rembourser tout le montant de la commande. Le processus de remboursement pour de telles commandes est décrit en détail ici.

- Dans les commandes sans panier de produits dans le statut Confirmée, cliquer sur le bouton Remboursement ouvre la fenêtre de confirmation de remboursement.

Vérifiez le montant du remboursement. Vous pouvez rembourser tout le montant ou indiquer un montant inférieur. Cliquez sur Confirmer. La commande passera au statut Remboursement. Si à l'étape précédente vous avez décidé de rembourser un montant inférieur, vous pouvez effectuer des remboursements jusqu'à ce que tout le montant soit remboursé

Type de remboursement selon la stadialité, le statut du paiement et la présence d'un panier de produits

Le tableau ci-dessous montre toutes les variantes de remboursement selon le statut du paiement, le nombre d'étapes, et la présence d'un panier de produits. Telle ou telle fonctionnalité peut être indisponible si votre utilisateur n'a pas les droits correspondants dans le système. Le principe général est que lorsqu'il est possible d'annuler la commande, l'annulation est effectuée, et si cette possibilité n'existe pas, alors un remboursement est effectué.

| Avec panier | Sans panier | |

| Une étape | Terminée - remboursement par positions de produits | Terminée - remboursement par montant, partiel possible |

| Deux étapes |

Confirmée - annulation, seulement montant total Terminée - remboursement par positions de produits |

Confirmée - annulation, seulement montant total Terminée - remboursement par montant, partiel possible |

Portefeuilles électroniques et certificats

La passerelle de paiement prend en charge le paiement tokenisé à l'aide des portefeuilles électroniques Apple Pay, Google Pay et Samsung Pay.

La documentation est disponible ici

Constructeur de pages de paiement

Le constructeur permet de modifier la page de paiement sans nécessité d'écrire du code. Il se trouve dans la section Constructeur du compte personnel.

Pour accéder à la section Constructeur, dans le menu de navigation gauche du compte personnel, sélectionnez l'élément ![]() .

.

Aperçu

Dans cette section, la page est divisée en deux sections :

- Dans la partie gauche sont rassemblés tous les paramètres nécessaires pour l'affichage sur la page de paiement ;

- Dans la partie droite s'affiche la page de paiement configurable, que vous pouvez modifier en définissant les paramètres dans la partie gauche de la page.

Dans la section Constructeur de pages de paiement vous pouvez :

- Modifier le schéma de couleurs

- Télécharger le logo du vendeur

- Définir l'affichage du logo de la banque

- Supprimer l'affichage du minuteur

Paramètres

Nom du magasin

D'abord, indiquez le nom du magasin :

Logo

Vous pouvez télécharger le logo du vendeur et/ou choisir le logo de la banque. Pour télécharger le logo du vendeur, cliquez sur Logo et sélectionnez Logo du marchand ou Logo du marchand et de la banque, puis téléchargez le fichier du logo du vendeur.

Seul le format .png est pris en charge. Si vous téléchargez des fichiers d'autres formats, une erreur sera affichée.

Vous pouvez renoncer à l'affichage du logo de la banque. Pour cela, sélectionnez l'option Sans logo :

Minuteur

Définissez si le minuteur de compte à rebours pour effectuer le paiement sera affiché sur la page de paiement ou non :

Formes

Le constructeur permet de définir des objets sur la page de paiement. Veuillez sélectionner dans la liste déroulante :

Polices

Le constructeur permet de choisir les polices sur la page de paiement. Sélectionnez dans la liste déroulante :

Paramètres de couleur

Le constructeur permet de définir le thème de couleur de la page. Vous pouvez choisir l'un des thèmes existants ou créer le vôtre :

Page de paiement

Dans la liste déroulante en haut de la page, vous pouvez sélectionner Page de paiement ou Page finale.

De plus, en haut de la page, vous pouvez sélectionner le format d'affichage de la page de paiement – bureau ou mobile.

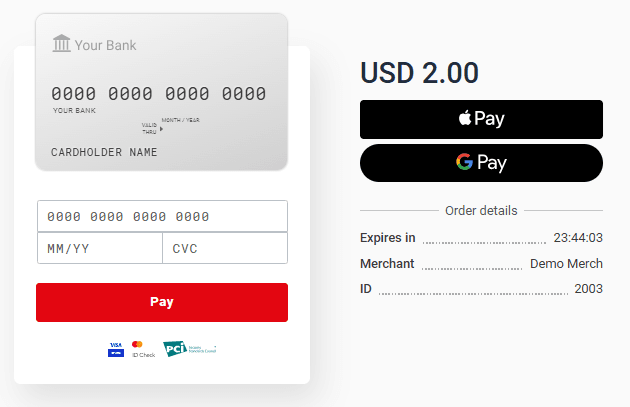

Exemples

Page de paiement :

Page de finalisation :

Catalogue de produits

La section Catalogue de produits permet de sélectionner rapidement les produits lors de la création d'une facture de paiement. Pour accéder à la section Catalogue de produits, cliquez sur ![]() dans le menu de gauche.

dans le menu de gauche.

La page de la section ressemble à ceci :

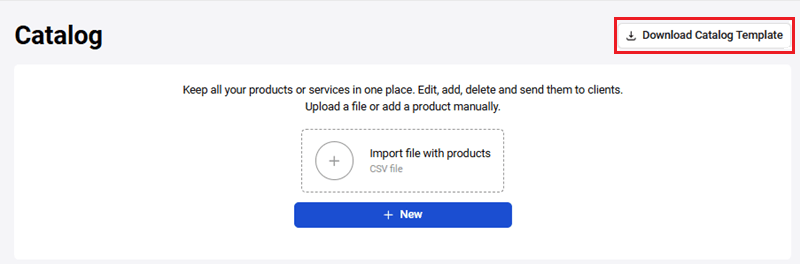

Pour commencer le travail, sélectionnez le marchand dans la liste déroulante, téléchargez le modèle de catalogue en cliquant sur le bouton Télécharger le modèle de catalogue, et remplissez les paramètres du produit :

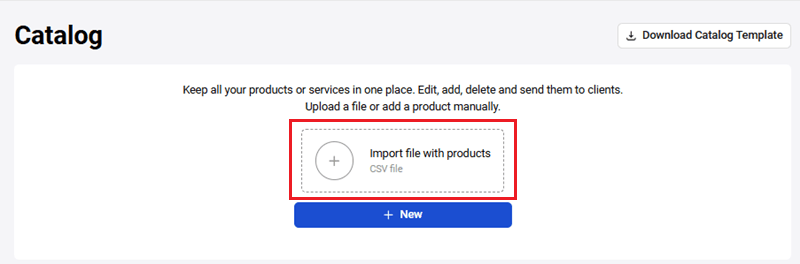

Ensuite, chargez le catalogue de produits fini au format .CSV, en utilisant le bouton Import de fichier avec les produits :

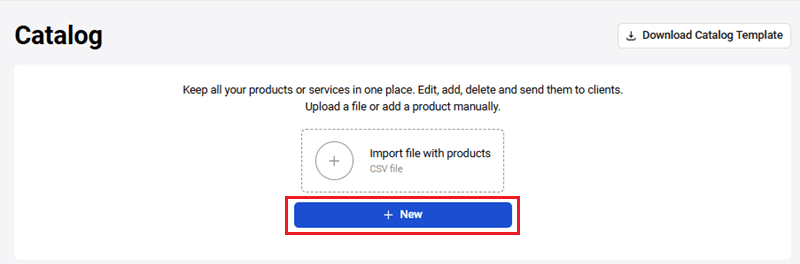

Ou bien ajoutez un produit en utilisant le bouton Nouveau.

Un formulaire pour remplir les informations sur le produit s'ouvrira.

Remplissez les champs nécessaires en vous guidant du tableau ci-dessous.

| Champ | Description |

|---|---|

| Dénomination | Dénomination du produit ou du service. |

| Prix | Prix par unité de la position de marchandise. |

| Unité de mesure | Unité de mesure, par exemple : l — litres, pcs. — pièces. |

| Article | Article de la position de marchandise. |

Après le chargement du catalogue de produits ou du/des produit(s) séparément, vous pourrez ajouter des produits du catalogue lors de l'établissement de la facture de paiement. Pour plus de détails sur comment ajouter des produits du catalogue, consultez la section Facture de paiement.

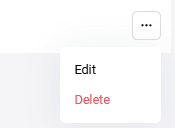

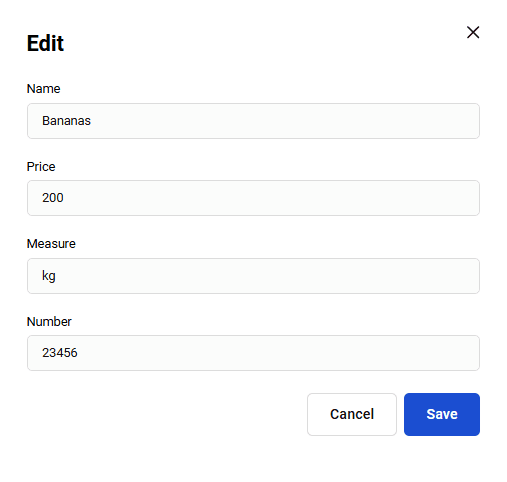

En plus de l'ajout de produit au catalogue, vous pouvez, en cas de nécessité, apporter des modifications aux paramètres du produit ajouté, ou même le supprimer complètement du catalogue. Pour cela, il faut placer le curseur sur la ligne du produit dans la liste et cliquer sur le bouton correspondant :

En cliquant sur le bouton d'édition, un formulaire pour modifier le produit s'ouvrira :

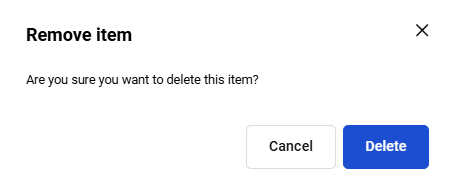

En cliquant sur le bouton de suppression du produit, une fenêtre pour confirmer ou annuler l'action s'ouvrira :

Boutons rapides

La section Boutons rapides permet de connecter rapidement des boutons pour le paiement par Apple Pay / Google Pay sur votre site. Pour ouvrir la section Boutons rapides, cliquez sur ![]() dans le panneau de navigation de gauche.

dans le panneau de navigation de gauche.

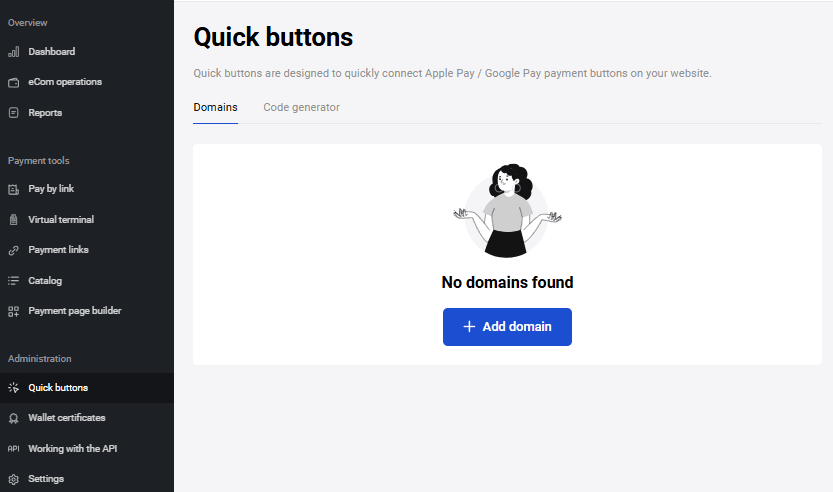

La page s'ouvrira :

La page contient deux onglets : Domaines et Générateur de code.

Domaines

L'onglet Domaines permet d'enregistrer le domaine de votre boutique dans la Passerelle de paiement avec vérification Apple Services. Ceci est nécessaire pour commencer à recevoir des paiements par Apple Pay.

Apple Pay génère un fichier de vérification qui doit être placé dans le sous-dossier suivant de votre domaine avant l'enregistrement :

/.well-known/apple-developer-merchantid-domain-association

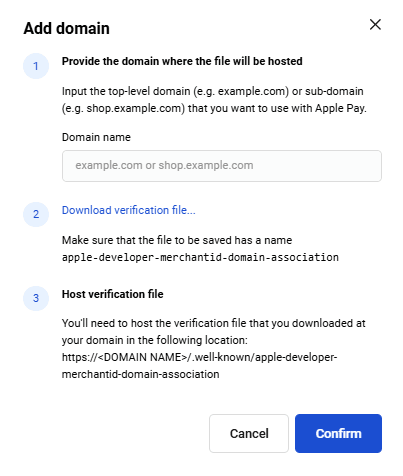

Pour enregistrer le domaine, cliquez sur le bouton Ajouter domaine. La fenêtre Ajouter domaine s'ouvrira.

- Dans le champ Nom de domaine, saisissez le nom du domaine de niveau supérieur (par exemple, example.com) ou de troisième niveau (par exemple, shop.example.com) que vous souhaitez utiliser pour les paiements Apple Pay.

- Téléchargez le fichier de vérification Apple Pay.

- Placez le fichier au chemin indiqué sur votre serveur web :

https://<DOMAIN NAME>/.well-known/apple-developer-merchantid-domain-association. - Cliquez sur le bouton Ajouter domaine.

Le domaine de la boutique sera enregistré dans la Passerelle de paiement avec la possibilité d'accepter les paiements Apple Pay.

Le nom de domaine sera affiché dans la liste des domaines sur l'onglet Domaines.

Générateur de code

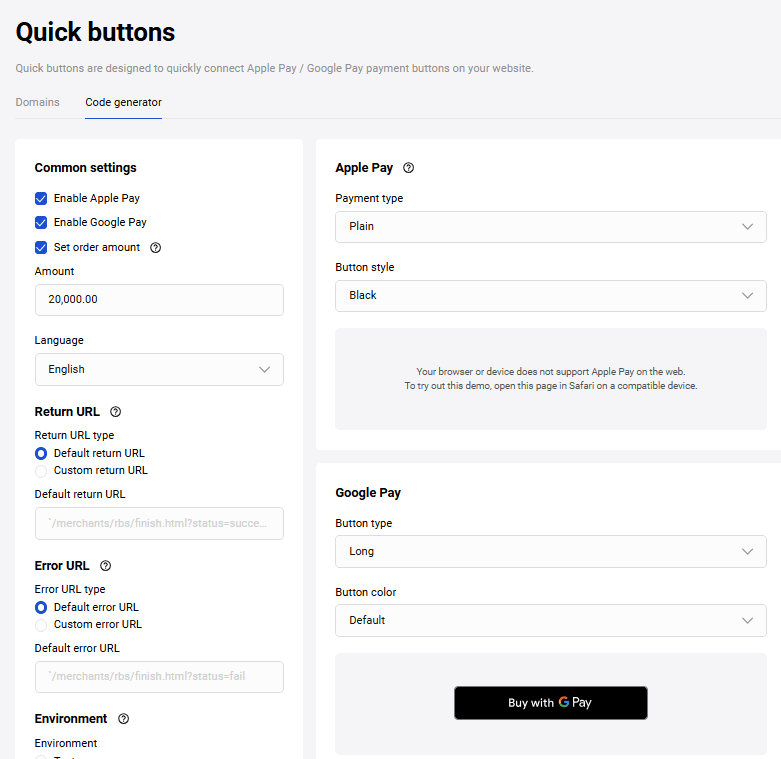

Cet onglet contient un constructeur pour générer le code du script Payment Widget, qui est utilisé pour connecter rapidement les boutons Apple Pay et Google Pay sur la page de la boutique. Voir plus en détails ici.

L'onglet comprend les sections suivantes pour définir les paramètres d'initialisation du script :

-

Paramètres généraux - indiquez les informations générales pour l'enregistrement de la commande dans la Passerelle de paiement :

- Activer le paiement via Apple Pay et/ou Google Pay,

- Numéro de commande,

- Montant (obligatoire),

- Devise (sélectionnez dans la liste),

- Langue (sélectionnez dans la liste),

- Environnement (test ou production)

- Page de paiement réussi et Page de paiement échoué (indiquez l'URL ou choisissez l'URL standard).

- Demande de données utilisateur - indiquez les données qui seront obligatoires pendant le paiement via PaymentRequest API pour Google Pay. Cochez les cases correspondantes : Nom, E-mail, Numéro de téléphone, Adresse postale.

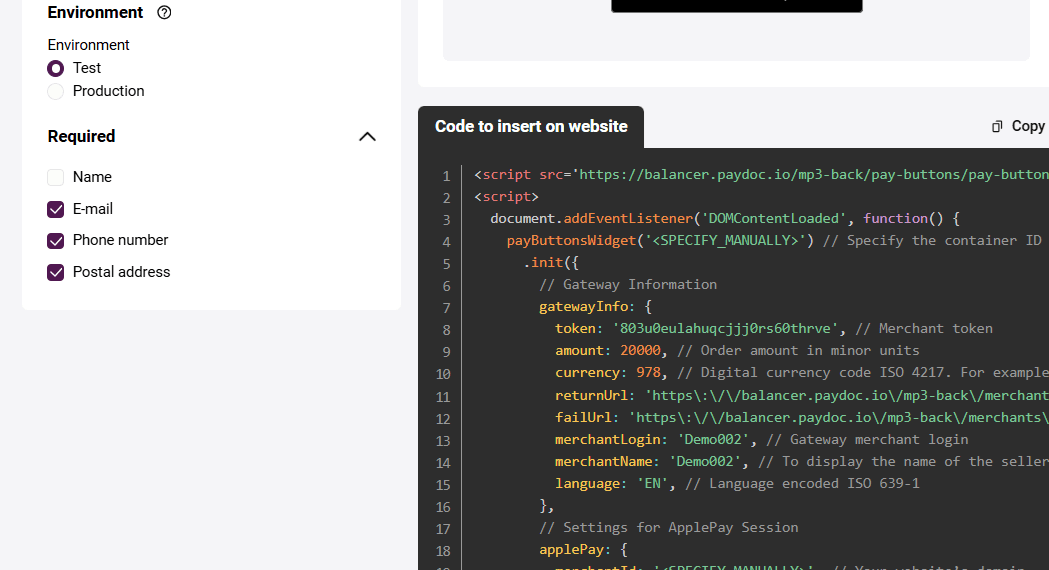

- Paramètres des boutons de paiement - indiquez le type d'apparence et le style des boutons Apple Pay et Google Pay. Un aperçu du bouton est disponible sur l'onglet.

- Code à insérer sur votre page - cette section contient un aperçu du code d'initialisation du script selon les paramètres indiqués. Ce code doit être inséré sur votre page.