Descripción general

Puede utilizar nuestro API de vendedor para crear el escenario de pago que necesite. Por ejemplo, puede crear su propia página de pago completamente configurada y conectarla a nuestra pasarela de pago.

Puede descargar la colección de solicitudes API para Postman para probar las funcionalidades básicas del API. Asegúrese de enviar las solicitudes como POST con atributos en el cuerpo de la solicitud.

Obligatoriedad de parámetros

La obligatoriedad de presencia del parámetro en la solicitud/respuesta puede tomar los siguientes valores:

- Obligatorio - el parámetro debe estar presente siempre. En caso de ausencia del valor se requiere transmitir un valor vacío dependiendo del formato;

- No obligatorio - el parámetro puede tanto estar presente como ausente, mientras que su presencia redundante no llevará a un error del sistema;

- Condición - el parámetro puede tanto estar presente (ser obligatorio) como ausente dependiendo de una o varias condiciones.

La obligatoriedad de transmisión del parámetro en la descripción de solicitud/respuesta se indica en la columna del mismo nombre "Obligatoriedad".

Autenticación

Para la autenticación del comerciante en la pasarela de pagos se pueden utilizar dos métodos.

- Utilizando el login y contraseña del usuario API del comerciante (cuenta con sufijo

-api), obtenido durante el registro. Estos valores se transmiten en los parámetrosuserNameypasswordrespectivamente (ver tabla a continuación).

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Condición | userName |

String [1..30] | Login de la cuenta API del vendedor. Si se utiliza un token público (parámetro token) para la autenticación durante el registro en lugar del login y la contraseña, no es necesario transmitir la contraseña. |

| Condición | password |

String [1..30] | Contraseña de la cuenta API del vendedor. Si para la autenticación durante el registro se utiliza un token público (parámetro token) en lugar de login y contraseña, no es necesario transmitir la contraseña. |

- Con ayuda de un token especial - su valor puede solicitarlo en el servicio de soporte técnico. En las solicitudes su valor se transmite en el parámetro

token(ver tabla a continuación).

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Condición | token |

String [1..256] | Valor utilizado para la autenticación del vendedor al enviar solicitudes al gateway de pago. Si transmites este parámetro, no transmitas userName y password. |

URL para llamadas API

TEST: https://dev.bpcbt.com/payment/rest/

PROD: https://dev.bpcbt.com/payment/rest/

Errores

Códigos de estado HTTP:

200- en caso de llamadas API del gateway de pago es necesario analizar JSON de la respuesta para determinar si el procesamiento de la transacción fue exitoso o no. El éxito se indica por:

- valor del parámetrosuccessigual atrue

- valor del parámetroerrorCodeigual a0

Si están presentes ambos parámetros,successtiene prioridad sobreerrorCode.400- ocurrió un error interno en el sistema.404- error en la llamada API - URL incorrecta (no existe).429- este código significa que el sistema está sobrecargado. Muy frecuentemente la razón principal es que se alcanzó el límite de solicitudes por segundo o el límite de solicitudes simultáneas. Pero también puede estar relacionado con que el sistema en general está sobrecargado (independientemente de sus solicitudes).500 o 502- este código significa que algo salió mal de nuestro lado.

Si la solicitud relacionada con el pago del pedido se procesó exitosamente, esto aún no significa que el pago mismo fue exitoso.

Para determinar si el pago fue exitoso o no, puede referirse a la descripción de la solicitud utilizada. También para determinar el estado del pago siempre se puede usar el algoritmo descrito a continuación

- Hacer una llamada getOrderStatusExtended.do;

- Verificar el campo

orderStatusen la respuesta: el pedido se considera pagado solo si el valororderStatuses igual a1o2.

Firma de solicitud API

En algunos casos para garantizar el intercambio seguro de datos puede ser necesario implementar una firma asimétrica de solicitud. Generalmente este requisito se aplica solo si está ejecutando solicitudes P2P/AFT/OCT.

Para tener la posibilidad de firmar solicitudes, necesita ejecutar los siguientes pasos:

- Cree y cargue un certificado.

- Calcule hash y firma, usando su clave privada, y transmita el hash generado (X-Hash) y valor de firma (X-Signature) en el encabezado de la solicitud.

Estos pasos están descritos detalladamente abajo.

Creación y carga de certificado

-

Cree una clave privada RSA de 2048 bits. El método de generación depende de la política de confidencialidad en su empresa. Por ejemplo, puede hacer esto con ayuda de OpenSSL:

openssl genrsa -des3 -out private.key 2048 -

Cree un CSR público (solicitud de firma de certificado), usando la clave privada generada:

openssl req -key private.key -new -out public.csr -

Cree un certificado, usando la clave privada generada y CSR. Ejemplo de formación de certificado por 5 años:

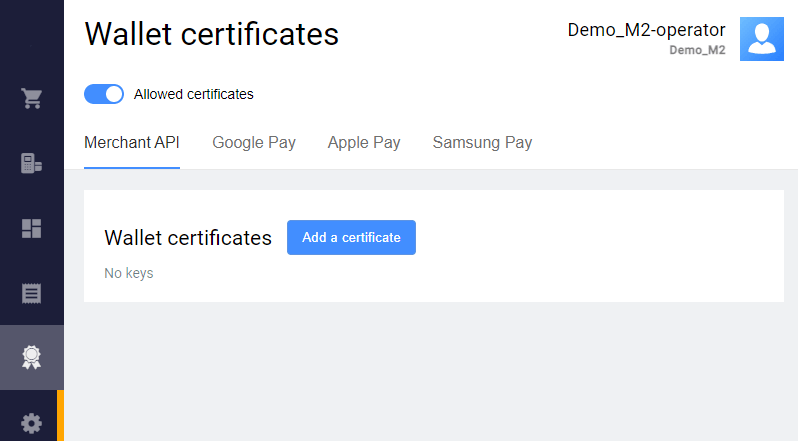

openssl x509 -signkey private.key -in public.csr -req -days 1825 -out public.cer Cargue el certificado generado en el Gabinete Personal. Para esto vaya a Certificados de billeteras > Merchant API, presione Agregar certificado y cargue el certificado público generado.

Cálculo de hash y firma

-

Calcule el hash SHA256 del cuerpo de la solicitud de la siguiente manera:

- Use el cuerpo de la solicitud en forma de cadena (en nuestro ejemplo esto es

amount=10000&password=gcjgcW1&returnUrl=http&userName=signature-api). - Calcule el hash SHA256 de esta cadena en bytes sin procesar.

- Convierta los bytes sin procesar a codificación base64.

- Use el cuerpo de la solicitud en forma de cadena (en nuestro ejemplo esto es

Genere una firma para el hash SHA256 calculado con ayuda del algoritmo RSA, usando la clave privada.

En nuestro ejemplo usamos la siguiente clave privada con contraseña 12345:

-----BEGIN RSA PRIVATE KEY-----

Proc-Type: 4,ENCRYPTED

DEK-Info: DES-EDE3-CBC,C502560EDE8F82B7

O4+bY1Q1ZcXFLDGVE8s9G2iVISHR/c/IMZKZEjkBED/TbuOCUGVjcav2ZaZO2dO0

lm771N6JNB01uhJbTHScVQ6R0UnGezHFTcsJlAlBa9RQyOwujs4Pk6riOGnLliIs

urnTXD0oskBR1wLRA2kp8+V0UPOAMXQaoLxFGE/o8taDGSrkyIcYTBoh9o7ZBxvO

SqUWAt2vPbGVyc6XspyuVtgHgEctaJO+E26QTweqdpN5JITF+fDFPNwUrFHoho4N

pxpKRWbiCJSpbvbsvhdizkmfgvRw+qYJvTirF3JTfGr14DttudFwjm7sNrr0JILR

XPKDUhRyWjkthZM+oDjF2HwISAGkbxcpn4PU7Tywq0uax+5KCQQn2uz4jLM2P6+9

000cvVLwhMnoUdOxuISRXeOcOWVyTO1mPfKiWnHaoO4yS3Y36OCIOe9RHGP8TTmq

acb3LUIF30eQyk3KxH/tUB0ScPDKEKMiww13/Kcfr0JkdIe/BWCvV+hSQm38TLQe

bTFy+wnD9kHACCwTSVVSOO+rHgJGVIyLgnpClZKWQyyJ4clH7/cORA7mTmp85Ckx

IjV5Egu0bPPUMudOB5BnQ4u85RnqXavasgrLRA3JZM4+Jzl8MNy/fsFXnVBQLJJC

Wlz/B7S7W8sabRogFuiqkkPmXE/QcpdKQoY3yh748QqMSl8vkA6WgndyYv1EnDDl

jA5j7vSf0wKI8BHgdHBEWuEjn3X/s0S/BiPPI6puboYY90tYVJTWSQCR83QrMF3N

BIcMu4+RIYu6GWnPx9npZpt0858c670ZII56np24iMse3qgHCOZxsGOenK2x7ta6

163gvaD8bu8xoeQcGVfd6IMbXWVb0+z1hvWR5HWHSalof4lMzZrDsQDKc2UA0ygh

hA1+VAl1MAEHVLNCCmyG1SwRwg1PI7FfftW7YARngCZRWkJ1haj1fgy7rtYolrdv

lEz/vjFD6diABx67omGgfiJhWdiKIlzsYlX1SW7yaik/Uxf1j8gTFwY34y8ekVd9

6pQTzV2V/4a48ELZl4LvelLWyt1AB3AR+/fM7YG6LYIqlo+qnLtro7Bqu8RNTNRP

wcWCd04r/20ulFWMIH8pVa60C98pSdOXriWEI1KDLc0E/fCdhjW2kL+FTPLC7ORe

cuzmfI27+06P/BvLZq/FAVBrDAmkioKwe6XYzTjpK1p5jZ3IrNwjAiasY1MNxCRy

5ufhQwkW//d+VUdU5m8Sm30/kXe9UkxMaetXgzPxbB7+5QFFr0bi7D1MjIrJNtTx

5g5E+UfOhqrp8ztBht9csQeFYSYabyyGX4Lh7ymVWrKCVdHlJib3M36nvOjpV/lA

zf35sxFz9kaQqNK7xJdQ9Bx6TBUzLjpYhNry37vKk+SIB6Weo+LJ99mALMeX79CB

osRqZqX5yrZhaQ8bbpo981nvLy5xFnpRqCuSWVZrVMBq3LQLaOvaCeyGC0V+ZN0C

CU6lHlR6XQqd/IjoEN8+8aiVp6Ubw8FuD28TDaEvCltrX3ARL0xFpABsa42LgV1F

09Vi+ju7SSNDvbezN8q0EILq9xp/zNCVhMpyRCIXBq9fzHkyCZ5qMw==

-----END RSA PRIVATE KEY-----

Obtenemos la firma:

pJ/gM4PR1/mKGuIxMvTl5pYDDjJslb0BcXFnIxijFn5qKdPd7W+2ueoctziU7omnkYp01/BlracukH1GOPWMSO+9zKuTDdFueFm1utsS0zaPFU+dmc1niGDRWE0CbCXcti/rGSTDPsnR58mwqgVkbCWxKyCDtuo5LxiKPK9mzgWTUuJ8LX6f6u42MURi5tRG6a9dc8l/+J94g0YOk911R6Lqv2jcluEvZ9ZeMMt8hyxowb0eDaCHlussu2CAyqpE9V+EUAc81Jkwv96MMSsA6UnFwEaCV/k+kwYd0jHCx94m2yWX734p9cWsBW7Fr5F0zox9Yck4GOjqe9nJMMB9jQ==

3. Ahora debe pasar el hash generado (X-Hash) y el valor de la firma (X-Signature) en el encabezado de la solicitud. La solicitud se verá así:

curl --request POST \

--url https://dev.bpcbt.com/payment/rest/register.do \

--header 'content-type: application/x-www-form-urlencoded' \

--header 'X-Hash: eYkMUF+xaYJhsETTIGsctl6DBNZha1ITN8muCcWQtZk=' \

--header 'X-Signature: pJ/gM4PR1/mKGuIxMvTl5pYDDjJslb0BcXFnIxijFn5qKdPd7W+2ueoctziU7omnkYp01/BlracukH1GOPWMSO+9zKuTDdFueFm1utsS0zaPFU+dmc1niGDRWE0CbCXcti/rGSTDPsnR58mwqgVkbCWxKyCDtuo5LxiKPK9mzgWTUuJ8LX6f6u42MURi5tRG6a9dc8l/+J94g0YOk911R6Lqv2jcluEvZ9ZeMMt8hyxowb0eDaCHlussu2CAyqpE9V+EUAc81Jkwv96MMSsA6UnFwEaCV/k+kwYd0jHCx94m2yWX734p9cWsBW7Fr5F0zox9Yck4GOjqe9nJMMB9jQ==' \

--data 'amount=10000&password=gcjgcW1&returnUrl=http&userName=signature-api'La solicitud debe cumplir con los siguientes requisitos:

- Todos los parámetros de la solicitud se incluyen en el cuerpo de la solicitud (no en la URL)

-

Si los parámetros de la solicitud se pasan en formato JSON, debe usarse el siguiente encabezado:

--header 'content-type: application/json' -

Si los parámetros de la solicitud se pasan en formato Query (por ejemplo,

parameterA=valueA&parameterB=valueB), debe usarse el siguiente encabezado:--header 'content-type: application/x-www-form-urlencoded' La solicitud contiene el usuario y contraseña correctos del usuario API.

El encabezado

X-Hashcontiene el hash SHA256 del cuerpo de la solicitud (se calcula en el Paso 1).El encabezado

X-Signaturecontiene la firma para el hash SHA256, calculada usando el algoritmo RSA con la clave privada (se genera en el Paso 2).

Ejemplo de código Java

A continuación se muestra un ejemplo de código Java que carga la clave privada, calcula el hash SHA256, lo firma con la clave privada con contraseña 12345, y luego envía la solicitud register.do correcta:

import javax.net.ssl.HttpsURLConnection;

import java.io.BufferedReader;

import java.io.DataOutputStream;

import java.io.InputStream;

import java.io.InputStreamReader;

import java.net.URL;

import java.nio.file.Files;

import java.nio.file.Paths;

import java.security.KeyStore;

import java.security.MessageDigest;

import java.security.PrivateKey;

import java.security.Signature;

import java.util.Base64;

import static java.net.HttpURLConnection.HTTP_OK;

public class SimpleSignatureExample {

// Este ejemplo no está listo para producción. Solo muestra cómo usar firmas en API.

public static void main(String[] args) throws Exception {

// cargar clave privada desde jks

KeyStore ks = KeyStore.getInstance("JKS");

char[] pwd = "123456".toCharArray();

ks.load(Files.newInputStream(Paths.get("/path/to/certificates.jks")), pwd);

PrivateKey privateKey = (PrivateKey) ks.getKey("111111", pwd);

// Firmar

String httpBody = "amount=10000&password=gcjgcW1&returnUrl=http&userName=signature-api";

MessageDigest digest = MessageDigest.getInstance("SHA-256");

Signature signature = Signature.getInstance("SHA256withRSA");

signature.initSign(privateKey);

byte[] sha256 = digest.digest(httpBody.getBytes());

signature.update(sha256);

byte[] sign = signature.sign();

// Enviar

Base64.Encoder encoder = Base64.getEncoder();

HttpsURLConnection connection = (HttpsURLConnection) new URL("https://<YOUR_DOMAIN>/payment/rest/register.do").openConnection();

connection.setDoOutput(true);

connection.setDoInput(true);

connection.setRequestMethod("POST");

connection.addRequestProperty("content-type", "application/x-www-form-urlencoded");

connection.addRequestProperty("X-Hash", encoder.encodeToString(sha256));

connection.addRequestProperty("X-Signature", encoder.encodeToString(sign));

connection.addRequestProperty("Content-Length", String.valueOf(httpBody.getBytes().length));

try (final DataOutputStream outputStream = new DataOutputStream(connection.getOutputStream())) {

outputStream.write(httpBody.getBytes());

outputStream.flush();

}

connection.connect();

InputStream inputStream = connection.getResponseCode() == HTTP_OK ? connection.getInputStream() : connection.getErrorStream();

BufferedReader reader = new BufferedReader(new InputStreamReader(inputStream));

String line;

while ((line = reader.readLine()) != null) {

System.out.println(line);

}

}

}Ejemplo de código Python

A continuación se muestra un ejemplo de código Python que genera la firma:

import OpenSSL

from OpenSSL import crypto

import base64

from hashlib import sha256

key_file = open("./priv.pem", "r")

key = key_file.read()

key_file.close()

if key.startswith('-----BEGIN '):

pkey = crypto.load_privatekey(crypto.FILETYPE_PEM, key)

else:

pkey = crypto.load_pkcs12(key, password).get_privatekey()

data = "amount=2000¤cy=978&userName=test_user&password=test_user_password&returnUrl=https%3A%2F%2Fmybestmerchantreturnurl.com&description=my_first_order&language=en"

sha256_hash = sha256(data.encode()).digest()

base64_hash = base64.b64encode(sha256_hash)

print(base64_hash)

sign = OpenSSL.crypto.sign(pkey, sha256_hash, "sha256")

signed_base64 = base64.b64encode(sign)

print(signed_base64)El archivo de clave privada para el ejemplo de Python debe tener el formato:

-----BEGIN PRIVATE KEY-----

MIIEvwIBADANBgkqhkiG9w0BAQEFAASCBKkwggSlAgEAAoIBAQDdpOwhY/p9x0WmBd3HaDfCD+KYung3M8Cxrw0ozF+h//GltRdnkJD7ejsBDB6/YeIVXZeU3AyqWvsi/IfeHwnokGxVg2IMw8OPacY6o1x7W0EQtfRoZa2Cn2PMCpZhEHlIVraXZDDeg4HY26YP0FZxRbpNnpXhGbiop+Bq0wHeE3JIk53cRmwYhxdxMmvFpgNd6C3dYhmnQqLv6WSpVNDFbQxBVU+JDNyR9FQwB1dU2MadgYwFJnEssbhUkM+sXAC4Wv3qhcZek6MWeWsbFIIlyTPa1T3yrWSXIb4qFJEro4pRMmwQ72qG02p8EPx1tlveQo22TojV9WbTPtaVwQtxAgMBAAECggEBANheTGkYOYsZwgMdzPAB7BSU/0bLGdoBuoV6dqUyRdVWjqaOTwe519625uzR0R5RRqxGzlfyLKcM5Aa2cUhEEp8mhatA87G0Va8lue66VOjTH4RZq/tR7v0J7hlc6Ipe05brl5nYo+BEjriNS+I6Jnizcfid7IBvZJW4NFr0G+mWTxl2BhUK/Mk895n8hg9QtgSRoMNO4jK2f0vJrH4hBHehTYpjHx+QhbUyIvsp60bEnNOXzl054TuWBVCYAQHcHTTZowWMY0s1Z0kGNxwsqQm4amW/v+1EqCF4fjRDrU6v/kjDKxGFx9GJUktKZAe2T8e2LySjgGpJO5g4AdxIVpUCgYEA8x9te+i2ijxoS3kIUSwXaPq5EdKGWGl5mW8KZHzmt9LB/CqTKvSOiDkMGoAx/76t5QmKOYojP+Vsc2XdfQfhT6d00MGTdiPBd+8//MmQQ07/D1/PV58Jd1O8bQFU4fZCMpQl/8Azp9ix/NEx0sHDv2KigLfFMBVGeJxwSoU2JzMCgYEA6WJC0BDTA9vx+i+p9i/41f7ozpQuYey5sxdZa2emOSYen6ptxUFLAYXMxVDaBJ89PMUa8GzWoXHhgXzbuRJk74IzUhWgPpneS4HTr5KDStJh2TqWWVLwEIgLwxvtuw0i9uSEU64D/Czzm801lrOhVgmZsWwNpFtP8ujz0v84MssCgYEA1P4YhbB3kx2e5VfwgGSXUcIttr5wMi6deF0+hpCh9DNw/QEzkzNTV2ZbAzCCHSKo5/n2nbg2b3kIDQUWCL6JlqYHAghErwBeMztoHIddmoovjAGM/Z93xJGYhwremWOL1RHTRH7XAlomfG2tL43PdvDrmsbkut44sdujyLVxnt8CgYBirK3tBMADKLJVgmOM+FlwORe7iAFYW9tj8iJXe/pWvVxDS66fsOyCl0ytvHKBc8ZTdE7gilPw7JJYyi6oQDO25EjIkuYusaXALQMQf5TNRMgkLVY2LA/eHXdDpgJMjNBUrOeZ7cA3ldXl8MyQjCBRnTuDPVlDPWw/GulEM65SIwKBgQDIEv8XK2YBkZrr+0fZSFTQAeK4R7Ve3z4hbpHhJi41YanCNaEWoeYAuQd6/b/QLwABllvfJBDYCNnF8heUxqISpyWd+FZ8nhZtxBoKj5l80czTcutIz/M+ETcvl8FqnMBsoCdp1wodqaLkOx6DIldgKLze6AqKXl5lHUsU4mvVqg==

-----END PRIVATE KEY-----

Registro de pedido

Registro de pedido

Para el registro de pedido se utiliza la solicitud https://dev.bpcbt.com/payment/rest/register.do.

Al ejecutar la solicitud es necesario utilizar el encabezado:

Content-Type: application/x-www-form-urlencoded

Parámetros de solicitud

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Condición | userName |

String [1..30] | Login de la cuenta API del vendedor. Si se utiliza un token público (parámetro token) para la autenticación durante el registro en lugar del login y la contraseña, no es necesario transmitir la contraseña. |

| Condición | password |

String [1..30] | Contraseña de la cuenta API del vendedor. Si para la autenticación durante el registro se utiliza un token público (parámetro token) en lugar de login y contraseña, no es necesario transmitir la contraseña. |

| Condición | token |

String [1..256] | Valor utilizado para la autenticación del vendedor al enviar solicitudes al gateway de pago. Si transmites este parámetro, no transmitas userName y password. |

| Obligatorio | orderNumber |

String [1..36] | Número de pedido (ID) en el sistema del comerciante; debe ser único para cada pedido. |

| Obligatorio | amount |

Integer [0..12] | Importe del pago en unidades mínimas de la moneda (por ejemplo, en kopeks). |

| No obligatorio | currency |

String [3] | Código de moneda del pago ISO 4217. Si no se especifica, se utiliza el valor por defecto. Solo se permiten dígitos. |

| Obligatorio | returnUrl |

String [1..512] | Dirección a la que se requiere redirigir al usuario en caso de pago exitoso. La dirección debe especificarse completamente, incluyendo el protocolo utilizado (por ejemplo, https://mybestmerchantreturnurl.com en lugar de mybestmerchantreturnurl.com). De lo contrario, el usuario será redirigido a una dirección del siguiente tipo: https://dev.bpcbt.com/payment/<merchant_address>. |

| No obligatorio | failUrl |

String [1..512] | Dirección a la que se debe redirigir al usuario en caso de pago fallido. La dirección debe especificarse completamente, incluyendo el protocolo utilizado (por ejemplo, https://mybestmerchantreturnurl.com en lugar de mybestmerchantreturnurl.com). De lo contrario, el usuario será redirigido a una dirección del siguiente tipo: https://dev.bpcbt.com/payment/<merchant_address>. |

| No obligatorio | dynamicCallbackUrl |

String [1..512] | Parámetro para transmitir la dirección dinámica para recibir notificaciones callback de "pago" por pedido, activadas para el comerciante (autorización exitosa, débito exitoso, devolución, cancelación, rechazo de pago por timeout, rechazo de pago card present). Las notificaciones callback "no de pago" (activación/desactivación de vinculación, creación de vinculación), serán enviadas a la dirección callback estática. |

| No obligatorio | description |

String [1..598] | Descripción del pedido en cualquier formato. Para activar el envío de este campo al sistema de procesamiento, contacte con el servicio de soporte técnico. En este campo no está permitido transmitir datos personales o datos de pago (números de tarjetas, etc.). Este requisito está relacionado con el hecho de que la descripción del pedido no se enmascara en ningún lugar. |

| No obligatorio | language |

String [2] | Clave de idioma según ISO 639-1. Si no se especifica el idioma, se utiliza el idioma predeterminado especificado en la configuración de la tienda. Idiomas soportados: en,el,ro,bg,pt,sw,hu,it,pl,de,fr,kh,cn,es,ka,da,et,fi,lt,lv,nl,sv. |

| No obligatorio | ip |

String [1..39] | Dirección IP del pagador. IPv6 es compatible en todas las solicitudes (hasta 39 caracteres). |

| No obligatorio | clientId |

String [0..255] | Número de cliente (ID) en el sistema del comerciante — hasta 255 caracteres. Se utiliza para implementar la funcionalidad de vinculaciones. Puede devolverse en la respuesta, si al comerciante se le permite crear vinculaciones. La especificación de este parámetro al procesar pagos por vinculación es obligatoria. En caso contrario, el pago será imposible. |

| No obligatorio | merchantLogin |

String [1..255] | Para registrar un pedido en nombre de otro comerciante, especifica su login (para la cuenta API) en este parámetro. Se puede usar solo si tienes permiso para ver las transacciones de otros vendedores o si el vendedor especificado es tu vendedor subsidiario. |

| No obligatorio | cardholderName |

String [1..150] | Nombre del titular de la tarjeta en letras latinas. Al transmitir este parámetro, el nombre del titular de la tarjeta se mostrará en la página de pago. |

| No obligatorio | jsonParams |

Object | Conjunto de atributos adicionales de forma arbitraria, estructura:jsonParams={"param_1_name":"param_1_value",...,"param_n_name":"param_n_value"}Pueden ser transmitidos al Centro de Procesamiento, para el procesamiento posterior (se requiere configuración adicional - póngase en contacto con el soporte). Algunos atributos predefinidos de jsonParams:

|

| No obligatorio | sessionTimeoutSecs |

Integer [1..9] | Duración de vida del pedido en segundos. En caso de que el parámetro no esté especificado, se utilizará el valor indicado en la configuración del comerciante, o el tiempo por defecto (1200 segundos = 20 minutos). Si en la solicitud está presente el parámetro expirationDate, entonces el valor del parámetro sessionTimeoutSecs no se tiene en cuenta. |

| No obligatorio | expirationDate |

String [19] | Fecha y hora de vencimiento del pedido. Formato: yyyy-MM-ddTHH:mm:ss.Si este parámetro no se transmite en la solicitud, entonces para determinar el tiempo de vencimiento del pedido se utiliza el parámetro sessionTimeoutSecs. |

| No obligatorio | bindingId |

String [1..255] | Identificador de una vinculación ya existente (identificador de tarjeta tokenizada por el gateway). Solo se puede usar si el comerciante tiene permiso para trabajar con vinculaciones. Si este parámetro se transmite en esta solicitud, significa que:

|

| No obligatorio | features |

String | Funciones del pedido. Para especificar varias funciones, use este parámetro varias veces en una sola solicitud. A continuación se muestran los valores posibles.

|

| No obligatorio | postAddress |

String [1..255] | Dirección de entrega. |

| No obligatorio | orderBundle |

Object | Objeto que contiene la cesta de productos. La descripción de los elementos anidados se proporciona a continuación. |

| No obligatorio | feeInput |

Integer [0..8] | Tamaño de la comisión en unidades mínimas de moneda. La funcionalidad debe estar habilitada a nivel del comerciante en el gateway. |

| Condición | email |

String [1..40] | Correo electrónico para mostrar en la página de pago. Si las notificaciones del cliente están configuradas para el comerciante, es necesario especificar el correo electrónico. Ejemplo: client_mail@email.com. La dirección de correo electrónico no se verifica durante el registro, será verificada más tarde durante el pago. |

| No obligatorio | mcc |

Integer [4] | Merchant Category Code (código de categoría del comerciante). Para transmitir este parámetro es necesario un permiso especial. Solo se pueden usar valores de la lista permitida de MCC. Para obtener información más detallada, contacte al soporte técnico. |

| No obligatorio | mvv |

String [1..10] | Confirmación del comerciante de Mastercard para transacciones tokenizadas. Para transmitir este parámetro debe estar habilitada una configuración especial (contacte con soporte técnico). |

| No obligatorio | paymentFacilitator |

Object | Bloque con información sobre el facilitador de pagos, es decir, sobre el comerciante que permite a varios subcomerciantes aceptar pagos bajo su cuenta. Para transmitir este parámetro debe estar activada una configuración especial (contacte con el soporte técnico). Ver parámetros anidados. |

| No obligatorio | billingPayerData |

Object | Bloque con datos de registro del cliente (dirección, código postal), necesario para pasar la verificación de dirección en el marco de los servicios AVS/AVV. Obligatorio, si la función está activada para el vendedor en el lado de la Pasarela de Pagos. Ver parámetros anidados. |

| No obligatorio | shippingPayerData |

Object | Objeto que contiene datos sobre la entrega al cliente. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Ver parámetros anidados. |

| No obligatorio | preOrderPayerData |

Object | Objeto que contiene datos del pedido preliminar. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Ver parámetros anidados. |

| No obligatorio | orderPayerData |

Object | Objeto que contiene datos sobre el pagador del pedido. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Ver parámetros anidados. |

| No obligatorio | billingAndShippingAddressMatchIndicator |

String [1] | Indicador de coincidencia de la dirección de facturación del titular de la tarjeta y la dirección de envío. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Valores posibles:

|

A continuación se muestran los parámetros del bloque billingPayerData (datos sobre la dirección de registro del cliente).

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | billingCity |

String [0..50] | Ciudad registrada en la tarjeta específica en el Banco Emisor. |

| Opcional | billingCountry |

String [0..50] | País registrado para la tarjeta específica del banco emisor. Formato: ISO 3166-1 (Alpha 2 / Alpha 3 / Number-3) o nombre del país. Recomendamos transmitir el código ISO de dos/tres letras del país. |

| Opcional | billingAddressLine1 |

String [0..50] | Dirección registrada para la tarjeta específica en el Banco Emisor (dirección del pagador). Línea 1. Obligatorio para la verificación AVS. |

| Opcional | billingAddressLine2 |

String [0..50] | Dirección registrada para la tarjeta específica en el Banco Emisor. Línea 2. |

| Opcional | billingAddressLine3 |

String [0..50] | Dirección registrada para la tarjeta específica en el Banco Emisor. Línea 3. |

| Opcional | billingPostalCode |

String [0..9] | Código postal registrado para la tarjeta específica en el Banco Emisor. Obligatorio para la verificación AVS. |

| Opcional | billingState |

String [0..50] | Estado registrado para la tarjeta específica en el Banco Emisor. Formato: valor completo del código ISO 3166-2, su parte o nombre del estado/región. Puede contener letras solo del alfabeto latino. Recomendamos transmitir el código ISO de dos letras del estado/región. |

| Obligatorio | payerAccount |

String [1..32] | Número de cuenta del remitente. |

| Opcional | payerLastName |

String [1..64] | Apellido del remitente. |

| Opcional | payerFirstName |

String [1..35] | Nombre del remitente. |

| Opcional | payerMiddleName |

String [1..35] | Patronímico del remitente. |

| Opcional | payerCombinedName |

String [1..99] | Nombre completo del remitente. |

| Opcional | payerIdType |

String [1..8] | Tipo de documento de identificación proporcionado del remitente. Valores posibles:

|

| Opcional | payerIdNumber |

String [1..99] | Número del documento de identificación proporcionado del remitente. |

| Opcional | payerBirthday |

String [1..20] | Fecha de nacimiento del remitente en formato YYYYMMDD. |

Descripción de los parámetros del objeto shippingPayerData:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | shippingCity |

String [1..50] | Ciudad del cliente (de la dirección de entrega) |

| Opcional | shippingCountry |

String [1..50] | País del cliente |

| Opcional | shippingAddressLine1 |

String [1..50] | Dirección principal del cliente (de la dirección de entrega) |

| Opcional | shippingAddressLine2 |

String [1..50] | Dirección principal del cliente (de la dirección de entrega) |

| Opcional | shippingAddressLine3 |

String [1..50] | Dirección principal del cliente (de la dirección de entrega) |

| Opcional | shippingPostalCode |

String [1..16] | Código postal del cliente para entrega |

| Opcional | shippingState |

String [1..50] | Estado/región del comprador (de la dirección de entrega) |

| Opcional | shippingMethodIndicator |

Integer [2] | Indicador del método de entrega. Valores posibles:

|

| Opcional | deliveryTimeframe |

Integer [2] | Plazo de entrega del producto. Valores posibles:

|

| Opcional | deliveryEmail |

String [1..254] | Dirección de correo electrónico de destino para la entrega de distribución digital. Es preferible transmitir el correo electrónico en el parámetro de solicitud independiente email (pero si lo transmite en este bloque, se aplicarán las mismas reglas). |

Descripción de los parámetros del objeto preOrderPayerData:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | preOrderDate |

String [10] | Fecha esperada de entrega (para compras de preorden) en formato AAAAMMDD. |

| Opcional | preOrderPurchaseInd |

Integer [2] | Indicador de colocación por el cliente de un pedido para entrega disponible o futura. Valores posibles:

|

| Opcional | reorderItemsInd |

Integer [2] | Indicador de que el cliente vuelve a reservar una entrega previamente pagada como parte de un nuevo pedido. Valores posibles:

|

Descripción de los parámetros del objeto orderPayerData.

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | homePhone |

String [7..15] | Teléfono de casa del propietario de la tarjeta. Es necesario indicar siempre el código del país, pero el signo + o 00 al inicio se puede indicar u omitir. El número debe tener una longitud de 7 a 15 dígitos. De este modo, son posibles los siguientes valores:

|

| Opcional | workPhone |

String [7..15] | Teléfono de trabajo del propietario de la tarjeta. Es necesario indicar siempre el código del país, pero el signo + o 00 al inicio se puede indicar u omitir. El número debe tener una longitud de 7 a 15 dígitos. De este modo, son posibles los siguientes valores:

|

| Opcional | mobilePhone |

String [7..15] | Número de teléfono móvil del propietario de la tarjeta. Es necesario indicar siempre el código del país, pero el signo + o 00 al inicio se puede indicar u omitir. El número debe tener una longitud de 7 a 15 dígitos. De este modo, son posibles los siguientes valores:

Para los pagos por VISA con autorización 3DS es necesario indicar el correo electrónico o el número de teléfono del propietario de la tarjeta. Si tiene configurada la visualización del número de teléfono en la página de pago y usted indicó un número de teléfono incorrecto, el cliente podrá corregirlo en la página de pago. |

Descripción de parámetros en el objeto orderBundle:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | orderCreationDate |

String [19] | Fecha de creación del pedido en formato YYYY-MM-DDTHH:MM:SS. |

| Opcional | customerDetails |

Object | Bloque que contiene los atributos del cliente. La descripción de los atributos de la etiqueta se proporciona a continuación. |

| Obligatorio | cartItems |

Object | Objeto que contiene atributos de productos en el carrito. La descripción de elementos anidados se proporciona a continuación. |

Descripción de parámetros en el objeto customerDetails:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | contact |

String [0..40] | Método de contacto preferido por el cliente. |

| Opcional | fullName |

String [1..100] | Nombres y apellidos del pagador. |

| Opcional | passport |

String [1..100] | Serie y número del pasaporte del pagador en el siguiente formato: 2222888888

|

| Opcional | deliveryInfo |

Object | Objeto que contiene los atributos de la dirección de entrega. La descripción de los elementos anidados se proporciona a continuación. |

Descripción de los parámetros en el objeto deliveryInfo:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | deliveryType |

String [1..20] | Método de entrega. |

| Obligatorio | country |

String [2] | Código de país de dos letras para la entrega. |

| Obligatorio | city |

String [0..40] | Ciudad de destino. |

| Obligatorio | postAddress |

String [1..255] | Dirección de entrega. |

Descripción de parámetros en el objeto cartItems:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | items |

Object | Elemento del array con atributos de la posición de mercancía. La descripción de los elementos anidados se proporciona a continuación. |

Descripción de parámetros en el objeto items:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | positionId |

Integer [1..12] | Identificador único de la posición del producto en el carrito. |

| Obligatorio | name |

String [1..255] | Denominación o descripción de la partida de mercancía en forma libre. |

| No obligatorio | itemDetails |

Object | Objeto con parámetros de descripción de la posición de mercancía. La descripción de los elementos anidados se proporciona a continuación. |

| Obligatorio | quantity |

Object | Elemento que describe la cantidad total de posiciones de mercancías de un positionId y sus unidades de medida. La descripción de los elementos anidados se presenta a continuación. |

| No obligatorio | itemAmount |

Integer [1..12] | Suma del costo de todas las posiciones de mercancías de un positionId en unidades mínimas de moneda. itemAmount es obligatorio para la transmisión, solo si no se transmitió el parámetro itemPrice. En caso contrario, la transmisión de itemAmount no es requerida. Si en la solicitud se transmiten ambos parámetros: itemPrice e itemAmount, entonces itemAmount debe ser igual a itemPrice * quantity, en caso contrario la solicitud finalizará con error. |

| No obligatorio | itemPrice |

Integer [1..18] | Suma del costo de la posición de mercancía de un positionId en dinero en unidades mínimas de moneda. |

| No obligatorio | depositedItemAmount |

String [1..18] | Importe del débito para un positionId en unidades mínimas de moneda (por ejemplo, en copecks). |

| No obligatorio | itemCurrency |

Integer [3] | Código de moneda ISO 4217. Si no se especifica, se considera igual a la moneda del pedido. |

| Obligatorio | itemCode |

String [1..100] | Número (identificador) de la posición de mercancía en el sistema de la tienda. |

Descripción de los parámetros en el objeto quantity:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | value |

Number [1..18] | Cantidad de posiciones de mercancías de dicho positionId. Para indicar números fraccionarios utilice el punto decimal. Se permite un máximo de 3 dígitos después del punto. |

| Obligatorio | measure |

String [1..20] | Unidad de medida de la cantidad por posición. |

Descripción de parámetros en el objeto itemDetails:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | itemDetailsParams |

Object | Parámetro que describe información adicional sobre la posición de mercancía. La descripción de los elementos anidados se presenta a continuación. |

Descripción de parámetros en el objeto itemDetailsParams:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | value |

String [1..2000] | Información adicional sobre la posición de mercancías. |

| Obligatorio | name |

String [1..255] | Denominación del parámetro de descripción de detalle de la posición de mercancía |

Descripción de los parámetros del objeto paymentFacilitator:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | pfId |

String [1..11] | Identificador del facilitador de pagos. |

| Obligatorio | name |

String [1..40] | Nombre del facilitador de pago. |

| Opcional | isoId |

String [1..11] | Identificador ISO. |

| Obligatorio | subMerchants |

Array of objects | Matriz de objetos con información adicional sobre los subcomerciantes. Ver parámetros anidados a continuación. |

Parámetros del elemento de la matriz subMerchants:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | subMerchantId |

String [1..20] | Identificador del subcomerciante. |

| Obligatorio | name |

String [1..40] | Nombre del subcomerciante. |

| Obligatorio | address |

Object | Bloque con información sobre la dirección del subcomerciante. Ver parámetros anidados a continuación. |

Parámetros del objeto address:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | city |

String [1..50] | Ciudad del subcomerciante. |

| Obligatorio | postalCode |

String [1..16] | Código postal del subcomerciante. |

| Obligatorio | country |

Integer [2] | Código de país del subcomerciante en formato ISO 3166-1. |

| Opcional | street |

String [1..40] | Calle del subcomerciante. |

Ejemplo del objeto paymentFacilitator:

"paymentFacilitator" :{

"pfId": "PF123456",

"name": "Payment Facilitator Name",

"isoId": "ISO789",

"subMerchants": [

{

"subMerchantId": "SM001",

"name": "Sub Merchant 1",

"address": {

"city": "City 1",

"postalCode": "101000",

"country": "US",

"street": "Street 1"

}

},

{

"subMerchantId": "SM002",

"name": "Sub Merchant 2",

"address": {

"city": "City 2",

"postalCode": "190000",

"country": "US",

"street": "Street 2"

}

}

]

}Parámetros de respuesta

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | errorCode |

String [1..2] | Parámetro informativo en caso de error, que puede tener diferentes valores de código:

|

| Opcional | errorMessage |

String [1..512] | Parámetro informativo que es la descripción del error en caso de que ocurra un error. El valor de errorMessage puede variar, por lo que no se debe hacer referencia explícita a sus valores en el código. El idioma de descripción se especifica en el parámetro language de la solicitud. |

| Opcional | formUrl |

String [1..512] | URL del formulario de pago al cual será redirigido el comprador. La URL no se devuelve si el registro del pedido no se completó debido a un error especificado en errorCode. |

| Opcional | orderId |

String [1..36] | Número de pedido en la pasarela de pago. Único dentro de la pasarela de pago. |

Ejemplos

Ejemplo de solicitud

curl --request POST \

--url https://dev.bpcbt.com/payment/rest/register.do \

--header 'content-type: application/x-www-form-urlencoded' \

--data amount=123456 \

--data userName=test_user \

--data password=test_user_password \

--data orderNumber=1234567890ABCDEF \

--data returnUrl=https://mybestmerchantreturnurl.com \

--data failUrl=https://mybestmerchantfailurl.com \

--data email=test@test.com \

--data clientId=259753456 \

--data features=FORCE_SSL \

--data features=FORCE_TDS \

--data language=en \

--data 'jsonParams={"param_1_name":"param_1_value","param_2_name":"param_2_value"}'Ejemplo de respuesta - éxito

{

"orderId": "01491d0b-c848-7dd6-a20d-e96900a7d8c0",

"formUrl": "https://dev.bpcbt.com/payment/payment/merchants/ecom/payment_en.html?mdOrder=01491d0b-c848-7dd6-a20d-e96900a7d8c0"

}Ejemplo de respuesta - error

{

"errorCode": "1",

"errorMessage": "Order number is duplicated, order with given order number is processed already"

}Registro de pedido con preautorización

Para la solicitud de registro de pedido con preautorización se utiliza el método https://dev.bpcbt.com/payment/rest/registerPreAuth.do.

Al ejecutar la solicitud es necesario utilizar el encabezado:

Content-Type: application/x-www-form-urlencoded

Parámetros de solicitud

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Condición | userName |

String [1..30] | Login de la cuenta API del vendedor. Si se utiliza un token público (parámetro token) para la autenticación durante el registro en lugar del login y la contraseña, no es necesario transmitir la contraseña. |

| Condición | password |

String [1..30] | Contraseña de la cuenta API del vendedor. Si para la autenticación durante el registro se utiliza un token público (parámetro token) en lugar de login y contraseña, no es necesario transmitir la contraseña. |

| Condición | token |

String [1..256] | Valor utilizado para la autenticación del vendedor al enviar solicitudes al gateway de pago. Si transmites este parámetro, no transmitas userName y password. |

| Obligatorio | orderNumber |

String [1..36] | Número de pedido (ID) en el sistema del comerciante; debe ser único para cada pedido. |

| Obligatorio | amount |

Integer [0..12] | Importe del pago en unidades mínimas de la moneda (por ejemplo, en kopeks). |

| Opcional | currency |

String [3] | Código de moneda del pago ISO 4217. Si no se especifica, se utiliza el valor por defecto. Solo se permiten dígitos. |

| Obligatorio | returnUrl |

String [1..512] | Dirección a la que se requiere redirigir al usuario en caso de pago exitoso. La dirección debe especificarse completamente, incluyendo el protocolo utilizado (por ejemplo, https://mybestmerchantreturnurl.com en lugar de mybestmerchantreturnurl.com). De lo contrario, el usuario será redirigido a una dirección del siguiente tipo: https://dev.bpcbt.com/payment/<merchant_address>. |

| Opcional | failUrl |

String [1..512] | Dirección a la que se debe redirigir al usuario en caso de pago fallido. La dirección debe especificarse completamente, incluyendo el protocolo utilizado (por ejemplo, https://mybestmerchantreturnurl.com en lugar de mybestmerchantreturnurl.com). De lo contrario, el usuario será redirigido a una dirección del siguiente tipo: https://dev.bpcbt.com/payment/<merchant_address>. |

| Opcional | dynamicCallbackUrl |

String [1..512] | Parámetro para transmitir la dirección dinámica para recibir notificaciones callback de "pago" por pedido, activadas para el comerciante (autorización exitosa, débito exitoso, devolución, cancelación, rechazo de pago por timeout, rechazo de pago card present). Las notificaciones callback "no de pago" (activación/desactivación de vinculación, creación de vinculación), serán enviadas a la dirección callback estática. |

| Opcional | description |

String [1..598] | Descripción del pedido en cualquier formato. Para activar el envío de este campo al sistema de procesamiento, contacte con el servicio de soporte técnico. En este campo no está permitido transmitir datos personales o datos de pago (números de tarjetas, etc.). Este requisito está relacionado con el hecho de que la descripción del pedido no se enmascara en ningún lugar. |

| Opcional | ip |

String [1..39] | Dirección IP del pagador. IPv6 es compatible en todas las solicitudes (hasta 39 caracteres). |

| Opcional | language |

String [2] | Clave de idioma según ISO 639-1. Si no se especifica el idioma, se utiliza el idioma predeterminado especificado en la configuración de la tienda. Idiomas soportados: en,el,ro,bg,pt,sw,hu,it,pl,de,fr,kh,cn,es,ka,da,et,fi,lt,lv,nl,sv. |

| Opcional | clientId |

String [0..255] | Número de cliente (ID) en el sistema del comerciante — hasta 255 caracteres. Se utiliza para implementar la funcionalidad de vinculaciones. Puede devolverse en la respuesta, si al comerciante se le permite crear vinculaciones. La especificación de este parámetro al procesar pagos por vinculación es obligatoria. En caso contrario, el pago será imposible. |

| Opcional | merchantLogin |

String [1..255] | Para registrar un pedido en nombre de otro comerciante, especifica su login (para la cuenta API) en este parámetro. Se puede usar solo si tienes permiso para ver las transacciones de otros vendedores o si el vendedor especificado es tu vendedor subsidiario. |

| Opcional | cardholderName |

String [1..150] | Nombre del titular de la tarjeta en letras latinas. Al transmitir este parámetro, el nombre del titular de la tarjeta se mostrará en la página de pago. |

| Opcional | jsonParams |

Object | Conjunto de atributos adicionales de forma arbitraria, estructura:jsonParams={"param_1_name":"param_1_value",...,"param_n_name":"param_n_value"}Pueden ser transmitidos al Centro de Procesamiento, para el procesamiento posterior (se requiere configuración adicional - póngase en contacto con el soporte). Algunos atributos predefinidos de jsonParams:

|

| Opcional | sessionTimeoutSecs |

Integer [1..9] | Duración de vida del pedido en segundos. En caso de que el parámetro no esté especificado, se utilizará el valor indicado en la configuración del comerciante, o el tiempo por defecto (1200 segundos = 20 minutos). Si en la solicitud está presente el parámetro expirationDate, entonces el valor del parámetro sessionTimeoutSecs no se tiene en cuenta. |

| Opcional | expirationDate |

String [19] | Fecha y hora de vencimiento del pedido. Formato: yyyy-MM-ddTHH:mm:ss.Si este parámetro no se transmite en la solicitud, entonces para determinar el tiempo de vencimiento del pedido se utiliza el parámetro sessionTimeoutSecs. |

| Opcional | bindingId |

String [1..255] | Identificador de una vinculación ya existente (identificador de tarjeta tokenizada por el gateway). Solo se puede usar si el comerciante tiene permiso para trabajar con vinculaciones. Si este parámetro se transmite en esta solicitud, significa que:

|

| Opcional | features |

String | Funciones del pedido. Para especificar varias funciones, use este parámetro varias veces en una sola solicitud. A continuación se muestran los valores posibles.

|

| Opcional | autocompletionDate |

String [19] | Fecha y hora de finalización automática del pago de dos etapas en el siguiente formato: 2025-12-29T13:02:51. Zona horaria utilizada: UTC+0. Para habilitar el envío de este campo al sistema de procesamiento, contacte al servicio de soporte técnico. |

| Opcional | autoReverseDate |

String [19] | Fecha y hora de cancelación automática del pago de dos etapas en el siguiente formato: 2025-06-23T13:02:51. Zona horaria utilizada: UTC+0. Para habilitar el envío de este campo al sistema de procesamiento, contacte al servicio de soporte técnico. |

| Opcional | postAddress |

String [1..255] | Dirección de entrega. |

| Opcional | orderBundle |

Object | Objeto que contiene la cesta de productos. La descripción de los elementos anidados se proporciona a continuación. |

| Opcional | feeInput |

Integer [0..8] | Tamaño de la comisión en unidades mínimas de moneda. La funcionalidad debe estar habilitada a nivel del comerciante en el gateway. |

| Condición | email |

String [1..40] | Correo electrónico para mostrar en la página de pago. Si las notificaciones del cliente están configuradas para el comerciante, es necesario especificar el correo electrónico. Ejemplo: client_mail@email.com. La dirección de correo electrónico no se verifica durante el registro, será verificada más tarde durante el pago. |

| Opcional | mcc |

Integer [4] | Merchant Category Code (código de categoría del comerciante). Para transmitir este parámetro es necesario un permiso especial. Solo se pueden usar valores de la lista permitida de MCC. Para obtener información más detallada, contacte al soporte técnico. |

| Opcional | mvv |

String [1..10] | Confirmación del comerciante de Mastercard para transacciones tokenizadas. Para transmitir este parámetro debe estar habilitada una configuración especial (contacte con soporte técnico). |

| Opcional | paymentFacilitator |

Object | Bloque con información sobre el facilitador de pago, es decir, sobre el comerciante que permite a varios subcomerciantes aceptar pagos bajo su cuenta. Para transmitir este parámetro debe estar habilitada una configuración especial (contacte al soporte técnico). Ver parámetros anidados. |

| Opcional | billingPayerData |

Object | Bloque con datos de registro del cliente (dirección, código postal), necesario para pasar la verificación de dirección en el marco de los servicios AVS/AVV. Obligatorio, si la función está habilitada para el vendedor en el lado de la Pasarela de Pago. Ver parámetros anidados. |

| Opcional | shippingPayerData |

Object | Objeto que contiene datos sobre la entrega al cliente. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Ver parámetros anidados. |

| Opcional | preOrderPayerData |

Object | Objeto que contiene datos de pedido preliminar. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Ver parámetros anidados. |

| Opcional | orderPayerData |

Object | Objeto que contiene datos sobre el pagador del pedido. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Ver parámetros anidados. |

| Opcional | billingAndShippingAddressMatchIndicator |

String [1] | Indicador de coincidencia de la dirección de facturación del titular de la tarjeta y la dirección de envío. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Valores posibles:

|

A continuación se muestran los parámetros del bloque billingPayerData (datos sobre la dirección de registro del cliente).

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | billingCity |

String [0..50] | Ciudad registrada en la tarjeta específica en el Banco Emisor. |

| Opcional | billingCountry |

String [0..50] | País registrado para la tarjeta específica del banco emisor. Formato: ISO 3166-1 (Alpha 2 / Alpha 3 / Number-3) o nombre del país. Recomendamos transmitir el código ISO de dos/tres letras del país. |

| Opcional | billingAddressLine1 |

String [0..50] | Dirección registrada para la tarjeta específica en el Banco Emisor (dirección del pagador). Línea 1. Obligatorio para la verificación AVS. |

| Opcional | billingAddressLine2 |

String [0..50] | Dirección registrada para la tarjeta específica en el Banco Emisor. Línea 2. |

| Opcional | billingAddressLine3 |

String [0..50] | Dirección registrada para la tarjeta específica en el Banco Emisor. Línea 3. |

| Opcional | billingPostalCode |

String [0..9] | Código postal registrado para la tarjeta específica en el Banco Emisor. Obligatorio para la verificación AVS. |

| Opcional | billingState |

String [0..50] | Estado registrado para la tarjeta específica en el Banco Emisor. Formato: valor completo del código ISO 3166-2, su parte o nombre del estado/región. Puede contener letras solo del alfabeto latino. Recomendamos transmitir el código ISO de dos letras del estado/región. |

| Obligatorio | payerAccount |

String [1..32] | Número de cuenta del remitente. |

| Opcional | payerLastName |

String [1..64] | Apellido del remitente. |

| Opcional | payerFirstName |

String [1..35] | Nombre del remitente. |

| Opcional | payerMiddleName |

String [1..35] | Patronímico del remitente. |

| Opcional | payerCombinedName |

String [1..99] | Nombre completo del remitente. |

| Opcional | payerIdType |

String [1..8] | Tipo de documento de identificación proporcionado del remitente. Valores posibles:

|

| Opcional | payerIdNumber |

String [1..99] | Número del documento de identificación proporcionado del remitente. |

| Opcional | payerBirthday |

String [1..20] | Fecha de nacimiento del remitente en formato YYYYMMDD. |

Descripción de los parámetros del objeto shippingPayerData:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | shippingCity |

String [1..50] | Ciudad del cliente (de la dirección de entrega) |

| Opcional | shippingCountry |

String [1..50] | País del cliente |

| Opcional | shippingAddressLine1 |

String [1..50] | Dirección principal del cliente (de la dirección de entrega) |

| Opcional | shippingAddressLine2 |

String [1..50] | Dirección principal del cliente (de la dirección de entrega) |

| Opcional | shippingAddressLine3 |

String [1..50] | Dirección principal del cliente (de la dirección de entrega) |

| Opcional | shippingPostalCode |

String [1..16] | Código postal del cliente para entrega |

| Opcional | shippingState |

String [1..50] | Estado/región del comprador (de la dirección de entrega) |

| Opcional | shippingMethodIndicator |

Integer [2] | Indicador del método de entrega. Valores posibles:

|

| Opcional | deliveryTimeframe |

Integer [2] | Plazo de entrega del producto. Valores posibles:

|

| Opcional | deliveryEmail |

String [1..254] | Dirección de correo electrónico de destino para la entrega de distribución digital. Es preferible transmitir el correo electrónico en el parámetro de solicitud independiente email (pero si lo transmite en este bloque, se aplicarán las mismas reglas). |

Descripción de los parámetros del objeto preOrderPayerData:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | preOrderDate |

String [10] | Fecha esperada de entrega (para compras de preorden) en formato AAAAMMDD. |

| Opcional | preOrderPurchaseInd |

Integer [2] | Indicador de colocación por el cliente de un pedido para entrega disponible o futura. Valores posibles:

|

| Opcional | reorderItemsInd |

Integer [2] | Indicador de que el cliente vuelve a reservar una entrega previamente pagada como parte de un nuevo pedido. Valores posibles:

|

Descripción de los parámetros del objeto orderPayerData.

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | homePhone |

String [7..15] | Teléfono de casa del propietario de la tarjeta. Es necesario indicar siempre el código del país, pero el signo + o 00 al inicio se puede indicar u omitir. El número debe tener una longitud de 7 a 15 dígitos. De este modo, son posibles los siguientes valores:

|

| Opcional | workPhone |

String [7..15] | Teléfono de trabajo del propietario de la tarjeta. Es necesario indicar siempre el código del país, pero el signo + o 00 al inicio se puede indicar u omitir. El número debe tener una longitud de 7 a 15 dígitos. De este modo, son posibles los siguientes valores:

|

| Opcional | mobilePhone |

String [7..15] | Número de teléfono móvil del propietario de la tarjeta. Es necesario indicar siempre el código del país, pero el signo + o 00 al inicio se puede indicar u omitir. El número debe tener una longitud de 7 a 15 dígitos. De este modo, son posibles los siguientes valores:

Para los pagos por VISA con autorización 3DS es necesario indicar el correo electrónico o el número de teléfono del propietario de la tarjeta. Si tiene configurada la visualización del número de teléfono en la página de pago y usted indicó un número de teléfono incorrecto, el cliente podrá corregirlo en la página de pago. |

Descripción de parámetros en el objeto orderBundle:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | orderCreationDate |

String [19] | Fecha de creación del pedido en formato YYYY-MM-DDTHH:MM:SS. |

| Opcional | customerDetails |

Object | Bloque que contiene los atributos del cliente. La descripción de los atributos de la etiqueta se proporciona a continuación. |

| Obligatorio | cartItems |

Object | Objeto que contiene atributos de productos en el carrito. La descripción de elementos anidados se proporciona a continuación. |

Descripción de parámetros en el objeto customerDetails:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | contact |

String [0..40] | Método de contacto preferido por el cliente. |

| Opcional | fullName |

String [1..100] | Nombres y apellidos del pagador. |

| Opcional | passport |

String [1..100] | Serie y número del pasaporte del pagador en el siguiente formato: 2222888888

|

| Opcional | deliveryInfo |

Object | Objeto que contiene los atributos de la dirección de entrega. La descripción de los elementos anidados se proporciona a continuación. |

Descripción de los parámetros en el objeto deliveryInfo:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | deliveryType |

String [1..20] | Método de entrega. |

| Obligatorio | country |

String [2] | Código de país de dos letras para la entrega. |

| Obligatorio | city |

String [0..40] | Ciudad de destino. |

| Obligatorio | postAddress |

String [1..255] | Dirección de entrega. |

Descripción de parámetros en el objeto cartItems:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | items |

Object | Elemento del array con atributos de la posición de mercancía. La descripción de los elementos anidados se proporciona a continuación. |

Descripción de parámetros en el objeto items:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | positionId |

Integer [1..12] | Identificador único de la posición del producto en el carrito. |

| Obligatorio | name |

String [1..255] | Denominación o descripción de la partida de mercancía en forma libre. |

| No obligatorio | itemDetails |

Object | Objeto con parámetros de descripción de la posición de mercancía. La descripción de los elementos anidados se proporciona a continuación. |

| Obligatorio | quantity |

Object | Elemento que describe la cantidad total de posiciones de mercancías de un positionId y sus unidades de medida. La descripción de los elementos anidados se presenta a continuación. |

| No obligatorio | itemAmount |

Integer [1..12] | Suma del costo de todas las posiciones de mercancías de un positionId en unidades mínimas de moneda. itemAmount es obligatorio para la transmisión, solo si no se transmitió el parámetro itemPrice. En caso contrario, la transmisión de itemAmount no es requerida. Si en la solicitud se transmiten ambos parámetros: itemPrice e itemAmount, entonces itemAmount debe ser igual a itemPrice * quantity, en caso contrario la solicitud finalizará con error. |

| No obligatorio | itemPrice |

Integer [1..18] | Suma del costo de la posición de mercancía de un positionId en dinero en unidades mínimas de moneda. |

| No obligatorio | depositedItemAmount |

String [1..18] | Importe del débito para un positionId en unidades mínimas de moneda (por ejemplo, en copecks). |

| No obligatorio | itemCurrency |

Integer [3] | Código de moneda ISO 4217. Si no se especifica, se considera igual a la moneda del pedido. |

| Obligatorio | itemCode |

String [1..100] | Número (identificador) de la posición de mercancía en el sistema de la tienda. |

Descripción de los parámetros en el objeto quantity:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | value |

Number [1..18] | Cantidad de posiciones de mercancías de dicho positionId. Para indicar números fraccionarios utilice el punto decimal. Se permite un máximo de 3 dígitos después del punto. |

| Obligatorio | measure |

String [1..20] | Unidad de medida de la cantidad por posición. |

Descripción de parámetros en el objeto itemDetails:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | itemDetailsParams |

Object | Parámetro que describe información adicional sobre la posición de mercancía. La descripción de los elementos anidados se presenta a continuación. |

Descripción de parámetros en el objeto itemDetailsParams:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | value |

String [1..2000] | Información adicional sobre la posición de mercancías. |

| Obligatorio | name |

String [1..255] | Denominación del parámetro de descripción de detalle de la posición de mercancía |

Descripción de los parámetros del objeto paymentFacilitator:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | pfId |

String [1..11] | Identificador del facilitador de pagos. |

| Obligatorio | name |

String [1..40] | Nombre del facilitador de pago. |

| Opcional | isoId |

String [1..11] | Identificador ISO. |

| Obligatorio | subMerchants |

Array of objects | Matriz de objetos con información adicional sobre los subcomerciantes. Ver parámetros anidados a continuación. |

Parámetros del elemento de la matriz subMerchants:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | subMerchantId |

String [1..20] | Identificador del subcomerciante. |

| Obligatorio | name |

String [1..40] | Nombre del subcomerciante. |

| Obligatorio | address |

Object | Bloque con información sobre la dirección del subcomerciante. Ver parámetros anidados a continuación. |

Parámetros del objeto address:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | city |

String [1..50] | Ciudad del subcomerciante. |

| Obligatorio | postalCode |

String [1..16] | Código postal del subcomerciante. |

| Obligatorio | country |

Integer [2] | Código de país del subcomerciante en formato ISO 3166-1. |

| Opcional | street |

String [1..40] | Calle del subcomerciante. |

Ejemplo del objeto paymentFacilitator:

"paymentFacilitator" :{

"pfId": "PF123456",

"name": "Payment Facilitator Name",

"isoId": "ISO789",

"subMerchants": [

{

"subMerchantId": "SM001",

"name": "Sub Merchant 1",

"address": {

"city": "City 1",

"postalCode": "101000",

"country": "US",

"street": "Street 1"

}

},

{

"subMerchantId": "SM002",

"name": "Sub Merchant 2",

"address": {

"city": "City 2",

"postalCode": "190000",

"country": "US",

"street": "Street 2"

}

}

]

}Parámetros de respuesta

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | errorCode |

String [1..2] | Parámetro informativo en caso de error, que puede tener diferentes valores de código:

|

| Opcional | errorMessage |

String [1..512] | Parámetro informativo que es la descripción del error en caso de que ocurra un error. El valor de errorMessage puede variar, por lo que no se debe hacer referencia explícita a sus valores en el código. El idioma de descripción se especifica en el parámetro language de la solicitud. |

| Opcional | orderId |

String [1..36] | Número de pedido en la pasarela de pago. Único dentro de la pasarela de pago. |

| Opcional | formUrl |

String [1..512] | URL del formulario de pago al cual será redirigido el comprador. La URL no se devuelve si el registro del pedido no se completó debido a un error especificado en errorCode. |

Ejemplos

Ejemplo de solicitud

curl --request POST \

--url https://dev.bpcbt.com/payment/rest/registerPreAuth.do \

--header 'content-type: application/x-www-form-urlencoded' \

--data amount=2000 \

--data userName=test_user \

--data password=test_user_password \

--data returnUrl=https://mybestmerchantreturnurl.com \

--data orderNumber=1255555555555 \

--data clientId=259753456 \

--data language=enEjemplo de respuesta

{

"orderId": "01492437-d2fb-77fa-8db7-9e2900a7d8c0",

"formUrl": "https://dev.bpcbt.com/payment/merchants/pay/payment_en.html?mdOrder=01492437-d2fb-77fa-8db7-9e2900a7d8c0"

}Pagos directos

Pago del pedido

Para el pago de un pedido previamente registrado se utiliza la solicitud https://dev.bpcbt.com/payment/rest/paymentorder.do.

La solicitud se utiliza en modo MPI/3DS Server interno, para esto no se requiere la presencia de permisos adicionales y/o certificaciones.

La solicitud se utiliza en modo MPI/3DS Server externo si tiene un contrato con un sistema de pago internacional o un certificado que permite realizar autenticación 3DS de forma independiente.

Esto significa que puede utilizar su propio MPI/3DS Server para la autenticación del cliente utilizando la tecnología 3D Secure. Información adicional sobre el pago con MPI/3DS Server propio está disponible aquí.

Al ejecutar la solicitud es necesario utilizar el encabezado:

Content-Type: application/x-www-form-urlencoded

Pago del pedido (MPI/3DS Server interno)

El pago del pedido ocurre con la transmisión de datos de pago de tarjeta, así como con el uso de la tecnología de autenticación 3DS (la aplicación de autenticación se regula por configuraciones reguladas por el servicio de soporte).

Parámetros de solicitud

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Obligatorio | userName |

String [1..100] | Nombre de usuario de la cuenta API del vendedor. |

| Obligatorio | password |

String [1..30] | Contraseña de la cuenta API del vendedor. Si para la autenticación durante el registro se utiliza un token público (parámetro token) en lugar de login y contraseña, no es necesario transmitir la contraseña. |

| Obligatorio | MDORDER |

String [1..36] | Número de pedido en la pasarela de pago. |

| Obligatorio | $PAN |

Integer [1..19] | Número de tarjeta de pago. Obligatorio, si no se transmite seToken. |

| Obligatorio | $CVC |

String [3] | Código CVC/CVV2 en el reverso de la tarjeta. Obligatorio, si no se transmite seToken. Se permiten solo dígitos. |

| Obligatorio | YYYY |

Integer [4] | Año de vencimiento de la tarjeta de pago. Si seToken no se transmite, es obligatorio transmitir $EXPIRY, o YYYY y MM. |

| Obligatorio | MM |

Integer [2] | Mes de vencimiento de la tarjeta de pago. Si seToken no se transmite, es obligatorio transmitir $EXPIRY, o YYYY y MM. |

| Condición | $EXPIRY |

Integer [6] | Fecha de vencimiento de la tarjeta en el siguiente formato: YYYYMM. Redefine los parámetros YYYY y MM. Si seToken no se transmite, es obligatorio transmitir $EXPIRY o YYYY y MM. |

| Condición | seToken |

String | Datos cifrados de la tarjeta que reemplazan los parámetros $PAN, $CVC y $EXPIRY (o YYYY,MM). Obligatorio si se utiliza en lugar de los datos de la tarjeta.Parámetros obligatorios para la cadena seToken: timestamp, UUID, PAN, EXPDATE, MDORDER. Para más detalles sobre la generación de seToken ver aquí. Si seToken contiene datos cifrados sobre el enlace (bindingId), para el pago se debe utilizar la solicitud paymentOrderBinding.do. |

| Obligatorio | TEXT |

String [1..512] | Nombre del portador de la tarjeta. |

| Obligatorio | language |

String [2] | Clave de idioma según ISO 639-1. Si no se especifica el idioma, se utiliza el idioma predeterminado especificado en la configuración de la tienda. Idiomas soportados: en,el,ro,bg,pt,sw,hu,it,pl,de,fr,kh,cn,es,ka,da,et,fi,lt,lv,nl,sv. |

| Opcional | ip |

String [1..39] | Dirección IP del pagador. IPv6 es compatible en todas las solicitudes (hasta 39 caracteres). |

| Opcional | bindingNotNeeded |

Boolean | Valores permitidos:

|

| Opcional | jsonParams |

Object | Campos de información adicional para almacenamiento posterior, se transmiten de la siguiente forma: jsonParams={"param_1_name":"param_1_value",...,"param_n_name":"param_n_value"}.Pueden ser transmitidos al Centro de Procesamiento, para procesamiento posterior (se requiere configuración adicional - contacte con soporte). Si utiliza un MPI/3DS Server externo, la pasarela de pago espera que cada solicitud paymentOrder incluya una serie de parámetros adicionales, tales como eci, xid, cavv y otros. Información más detallada aquí.Para iniciar la autenticación 3RI, puede ser necesario que transmita una serie de parámetros adicionales (ver autenticación 3RI). Algunos atributos predefinidos de jsonParams:

|

| Opcional | threeDSSDK |

Boolean | Valores posibles: true o false Bandera que indica que el pago proviene del 3DS SDK. |

| Opcional | mcc |

Integer [4] | Merchant Category Code (código de categoría del comerciante). Para transmitir este parámetro es necesario un permiso especial. Solo se pueden usar valores de la lista permitida de MCC. Para obtener información más detallada, contacte al soporte técnico. |

| Opcional | mvv |

String [1..10] | Confirmación del comerciante de Mastercard para transacciones tokenizadas. Para transmitir este parámetro debe estar habilitada una configuración especial (contacte con soporte técnico). |

| Opcional | paymentFacilitator |

Object | Bloque con información sobre el facilitador de pagos, es decir, sobre el comerciante que permite a múltiples subcomerciantes aceptar pagos bajo su cuenta. Para transmitir este parámetro debe estar habilitada una configuración especial (contacte al soporte técnico). Ver parámetros anidados. |

| Condición | email |

String [1..40] | Correo electrónico para mostrar en la página de pago. Si las notificaciones del cliente están configuradas para el vendedor, es necesario especificar el correo electrónico. Ejemplo: client_mail@email.com. Para pagos con VISA con autorización 3DS es necesario especificar el correo electrónico o el número de teléfono del titular de la tarjeta. |

| Opcional | billingPayerData |

Object | Bloque con datos de registro del cliente (dirección, código postal), necesario para pasar la verificación de dirección en el marco de los servicios AVS/AVV. Obligatorio, si la función está habilitada para el vendedor en el lado de la Pasarela de Pago. Ver parámetros anidados. |

| Opcional | shippingPayerData |

Object | Objeto que contiene datos sobre la entrega al cliente. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Ver parámetros anidados. |

| Opcional | preOrderPayerData |

Object | Objeto que contiene datos de pedido previo. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Ver parámetros anidados. |

| Opcional | orderPayerData |

Object | Objeto que contiene datos sobre el pagador del pedido. Este parámetro se utiliza para la posterior autenticación 3DS del cliente. Ver parámetros anidados. |

| Opcional | tii |

String | Identificador del iniciador de la transacción. Parámetro que indica qué tipo de operación realizará el iniciador (Cliente o Comerciante). Valores posibles |

| Opcional | externalScaExemptionIndicator |

String | Tipo de excepción SCA (Strong Customer Authentication). Si se especifica este parámetro, la transacción será procesada dependiendo de sus configuraciones en la pasarela de pago: ya sea se ejecutará una operación SSL forzada, o el banco emisor recibirá información sobre la excepción SCA y tomará la decisión de realizar la operación con autenticación 3DS o sin ella (para obtener información detallada contacte con nuestro servicio de soporte). Valores permitidos:

Para transmitir este parámetro debe tener derechos suficientes en la pasarela de pago. |

| Opcional | clientBrowserInfo |

Object | Bloque de datos sobre el navegador del cliente, que se envía al ACS durante la autenticación 3DS. Este bloque se puede transmitir solo si está habilitada una configuración especial (contacte al equipo de soporte). Ver parámetros anidados. |

| Condición | originalPaymentNetRefNum |

String | Identificador de la transacción original o anterior exitosa en el sistema de pago en relación con la operación ejecutada por vinculación - TRN ID. Se transmite si el valor del parámetro tii = R,U o F.Obligatorio al usar las vinculaciones del comerciante en transferencias por vinculación. |

| Condición | originalPaymentDate |

String | Fecha de la transacción iniciadora. Valor en formato Unix timestamp en milisegundos. Se transmite si el valor del parámetro tii = R,U o F. |

| Opcional | acsInIFrame |

Boolean | Bandera que muestra que para la URL final se devolverá la versión iFrame. Valores posibles true or false. Para conectar esta funcionalidad, póngase en contacto con el servicio de soporte. |

A continuación se muestran los parámetros del bloque billingPayerData (datos sobre la dirección de registro del cliente).

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | billingCity |

String [0..50] | Ciudad registrada en la tarjeta específica en el Banco Emisor. |

| Opcional | billingCountry |

String [0..50] | País registrado para la tarjeta específica del banco emisor. Formato: ISO 3166-1 (Alpha 2 / Alpha 3 / Number-3) o nombre del país. Recomendamos transmitir el código ISO de dos/tres letras del país. |

| Opcional | billingAddressLine1 |

String [0..50] | Dirección registrada para la tarjeta específica en el Banco Emisor (dirección del pagador). Línea 1. Obligatorio para la verificación AVS. |

| Opcional | billingAddressLine2 |

String [0..50] | Dirección registrada para la tarjeta específica en el Banco Emisor. Línea 2. |

| Opcional | billingAddressLine3 |

String [0..50] | Dirección registrada para la tarjeta específica en el Banco Emisor. Línea 3. |

| Opcional | billingPostalCode |

String [0..9] | Código postal registrado para la tarjeta específica en el Banco Emisor. Obligatorio para la verificación AVS. |

| Opcional | billingState |

String [0..50] | Estado registrado para la tarjeta específica en el Banco Emisor. Formato: valor completo del código ISO 3166-2, su parte o nombre del estado/región. Puede contener letras solo del alfabeto latino. Recomendamos transmitir el código ISO de dos letras del estado/región. |

| Obligatorio | payerAccount |

String [1..32] | Número de cuenta del remitente. |

| Opcional | payerLastName |

String [1..64] | Apellido del remitente. |

| Opcional | payerFirstName |

String [1..35] | Nombre del remitente. |

| Opcional | payerMiddleName |

String [1..35] | Patronímico del remitente. |

| Opcional | payerCombinedName |

String [1..99] | Nombre completo del remitente. |

| Opcional | payerIdType |

String [1..8] | Tipo de documento de identificación proporcionado del remitente. Valores posibles:

|

| Opcional | payerIdNumber |

String [1..99] | Número del documento de identificación proporcionado del remitente. |

| Opcional | payerBirthday |

String [1..20] | Fecha de nacimiento del remitente en formato YYYYMMDD. |

Descripción de los parámetros del objeto shippingPayerData:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | shippingCity |

String [1..50] | Ciudad del cliente (de la dirección de entrega) |

| Opcional | shippingCountry |

String [1..50] | País del cliente |

| Opcional | shippingAddressLine1 |

String [1..50] | Dirección principal del cliente (de la dirección de entrega) |

| Opcional | shippingAddressLine2 |

String [1..50] | Dirección principal del cliente (de la dirección de entrega) |

| Opcional | shippingAddressLine3 |

String [1..50] | Dirección principal del cliente (de la dirección de entrega) |

| Opcional | shippingPostalCode |

String [1..16] | Código postal del cliente para entrega |

| Opcional | shippingState |

String [1..50] | Estado/región del comprador (de la dirección de entrega) |

| Opcional | shippingMethodIndicator |

Integer [2] | Indicador del método de entrega. Valores posibles:

|

| Opcional | deliveryTimeframe |

Integer [2] | Plazo de entrega del producto. Valores posibles:

|

| Opcional | deliveryEmail |

String [1..254] | Dirección de correo electrónico de destino para la entrega de distribución digital. Es preferible transmitir el correo electrónico en el parámetro de solicitud independiente email (pero si lo transmite en este bloque, se aplicarán las mismas reglas). |

Descripción de los parámetros del objeto preOrderPayerData:

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | preOrderDate |

String [10] | Fecha esperada de entrega (para compras de preorden) en formato AAAAMMDD. |

| Opcional | preOrderPurchaseInd |

Integer [2] | Indicador de colocación por el cliente de un pedido para entrega disponible o futura. Valores posibles:

|

| Opcional | reorderItemsInd |

Integer [2] | Indicador de que el cliente vuelve a reservar una entrega previamente pagada como parte de un nuevo pedido. Valores posibles:

|

Descripción de los parámetros del objeto orderPayerData.

| Obligatoriedad | Nombre | Tipo | Descripción |

|---|---|---|---|

| Opcional | homePhone |

String [7..15] | Teléfono de casa del propietario de la tarjeta. Es necesario indicar siempre el código del país, pero el signo + o 00 al inicio se puede indicar u omitir. El número debe tener una longitud de 7 a 15 dígitos. De este modo, son posibles los siguientes valores:

|

| Opcional | workPhone |

String [7..15] | Teléfono de trabajo del propietario de la tarjeta. Es necesario indicar siempre el código del país, pero el signo + o 00 al inicio se puede indicar u omitir. El número debe tener una longitud de 7 a 15 dígitos. De este modo, son posibles los siguientes valores:

|

| Opcional | mobilePhone |

String [7..15] | Número de teléfono móvil del propietario de la tarjeta. Es necesario indicar siempre el código del país, pero el signo + o 00 al inicio se puede indicar u omitir. El número debe tener una longitud de 7 a 15 dígitos. De este modo, son posibles los siguientes valores: